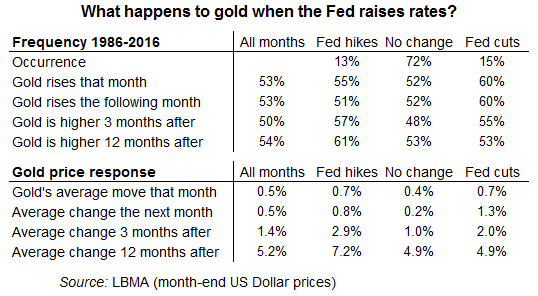

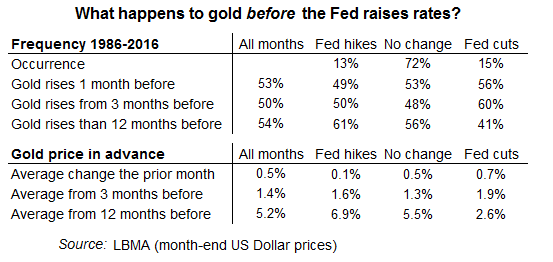

Although theory says that gold price should decline after an interest rate hike and it should increase after an interest rate cut, history shows that this anticipation is often wrong. The Gold market always try to predict the future development, and the interest rate change is often reflected by the prices before the rate change itself is officially announced. If there was a strong trend before the rate change, the trend may get disrupted for some time, although it tends to resume after the dust settles down.

It’s a fact that making money from financial trading means getting ahead of the move, buying before an asset goes up and selling it before it goes down. So if gold should fall when Fed rates go up – like everyone thinks, because it pays no income and so carries an opportunity cost in the form of lost interest on cash – then no one should want to wait. Sell early, provided you’re sure you know which way the Fed will go.

The story is that selling in advance works to depress gold prices before the Fed makes its announcement (just like buying before a rate cut pushes it higher). Brought forward in time, this self-fulfillment cracks open a gap between what intuitions says gold should do when the Fed raises (or cuts) and what actually happens after the fact.

Gold had first failed to reclaim that peak in 2012 when the Fed expanded its quantitative easing bond-buying program to $85 billion per month. Then gold sank in 2013 (as now ex-chairman Ben Bernanke muttered about ‘tapering’ QE) before steadying in 2014 (even as the taper became fact) only to slide again in 2015 (as Janet Yellen muttered time and again that her committee would, like, really really raise rates from zero before the end of last year).

The Fed squeezed its first hike into 2015, but only just! ‘Will they? When?’ finally ended, gold prices have barely looked back, marking 2016 with the strongest half-annual gains since the financial crisis broke in 2008. The Federal Reserve’s first interest-rate hike after 7 years stuck at zero last December finally put gold out of its misery. Marking a new 6-year low, gold prices hit $1046 per ounce straight after the Fed rate rise. A 27% jump came as the Fed failed to follow up with a second rate hike, never mind the two or three needed by September to keep the central bank’s own 2016 forecast on track. This is now the longest “pause” in any modern interest-rate cycle. Even if the Fed does raise at this week’s meeting, it begs the question whether this qualifies as a rate-hiking cycle. The Fed never waited so long as it did in 2009-2015 before making a change to rates. It has never now hemmed and hawed this long before following one rise with another.

Still, gold prices have softened over the summer, easing $50 per ounce from the 2-year Dollar peak of $1375 hit immediately after the UK’s Brexit referendum shock. Desperate as always for a narrative of ‘this plus that equals the other’, financial newswires and traders put gold’s retreat entirely down to Fed chit-chat – because some Fed members have switched to calling for a second rate rise sooner, rather than later, fretting about unintended consequences from today’s near-record low ceiling of 0.50%.

Well, go on then Janet, Stanley, Lael and the rest. Gold dares you.

Research Desk,

Shaikh Financial Services