PSX and the Buffet Indicator

It was Warren Buffett who first talked about the significance of Market Cap to GDP ratio in 2001, since then it is called ‘’ The Buffet Indicator ‘’.

Pakistani stock market capitalization is roughly 24% of GDP which in comparison to other countries is very low and has not improved in historic comparison. In US and majority of developed countries market cap to GDP is mostly in access to GDP, while in less developed countries this ratio is less than 50% of GDP.

Back in 2007 market capitalization to GDP had reached a high point of 47%. It fell to just 16% in 2008 after the steep fall in stock prices and the ratio climbed back to 30% in 2014/15 as market began the upward journey rising from 7000 to 35000 during the period 2009 to 2015. During 2015 market capitalization reached a high of Approx $76.6 billion (Rs 8200 billion) in August 2015 when the index recorded its all time high of 36,228. Since then it has fallen by 14% to $66 billion while the index has receded by 9.5%. This significant decline in total market cap of KSE is due to continuing weak performance of large market cap stocks mainly in oil & gas, banks and fertilizer sectors.

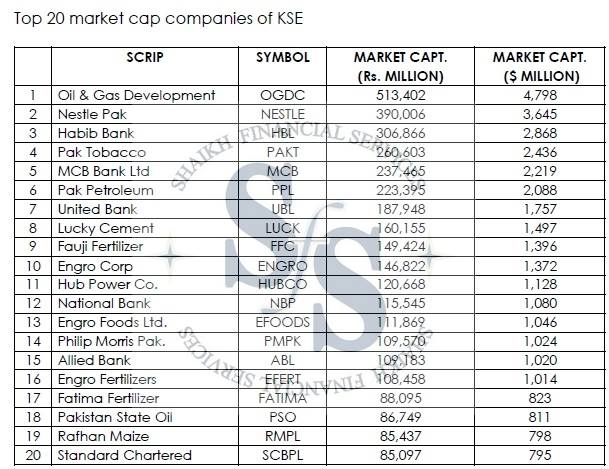

As of today, KSE total market capitalization is around $66 billion with 578 listed companies and out of these top 20 companies have a share of 52% in terms of capitalization. Only 16 companies have market capitalization of over $1 billion with OGDC the top market cap company at $4.8 billion, which has come down by over 50% since 2014. Nestle has been maintaining the second position for long time and is now $3.6 billion company (down 34% from its January 2014 peak).

In global comparison, KSE remains a small market and so are majority of the listed companies. Overall, there are 121 listed companies having over $100 million in market cap and together these represent 92% of total capitalization. As there are few large companies on KSE, at the same time there is huge list of very small companies of 335 having market cap of less than $10 million.

In the recent past, majority of big companies not only did they underperform the market but they also have little share in the total volume and total value traded on the exchange, and big volumes were recorded only when blocks of shares came in for selling. At the same time, bulk of the activity is taking place in relatively smaller (between $100 million-300 million) market cap companies. Prices of some smaller cap stocks have increased significantly and in some cases manifold amid high volumes in the recent past, however, given their smaller market weight their impact on total market capitalization have been limited.

Given the scenario of Pakistan, GDP is expected to increase by around 4% annually over the next few years, irrespective of government claim of pushing the growth to 6%.

Market Cap to GDP Ratio of Pakistani equities is around 50% down from it’s historic peak of 47% (back in 2007), hence leaving a signification room for appreciation in coming months/years. With likely GDP size of $250-260 billion in 2016, The growing economy will lead to expanding corporate sector which will get reflected in the size of these companies through their market capitalization.

In stock market, market capitalization of companies is hugely impacted by near term profit expectations which quite often lead to both excessive and depressed stock prices relative to intrinsic values. If profitability of large cap stocks is negatively impacted it will have more pronounced impact on the index and overall market capitalization. Movement in share prices of small cap stocks on the other hand has marginal impact on the index and total market capitalization. This is what we are observing now at KSE as market capitalization and index have come down due to depressed earnings outlook, especially for the market heavy weight oil and gas sector stocks (prices have fallen over 50% during past 12 months). If earnings outlook stays weak or downgraded for large cap stocks whichever sectors they are it will have visible negative impact on the index, notwithstanding growth in GDP and falling ratio of market capitalization.

While the ratio of market capitalization to GDP may not be relevant every time, it shouldn’t be overlooked in the broader context of stock market and the economy. As the economy grows and corporate sectors adjust themselves for growth and opportunities, stock market capitalization also advance due to growth in the size of companies and more listings on the exchanges.

This is a Re-Post of our Facebook Page Post.

Research Team,

Shaikh Financial Services

- Published in Stocks

- 1

- 2