GOLD: Swing Trade Alert !!

Current Gold Price: 1215/Oz

We closed our GOLD Long Positions at 1290/Oz few days back, which we initiated at 1110/Oz, booking a whooping gain of 180/Oz.

Now we initiate a New BUY Position in Gold at current rate of 1215/Oz.

Stop-Loss should be placed at 1195 & Target Price of 1290/Oz.

** Once Prices Reaches 1290, we will Whatsapp a new updated strategy to all of you.

NOTE: Daily Strategy will be sent as per routine on your Mobile Numbers, It should not be mixed with this Trade Entry.

Research Team,

Shaikh Financial Services

- Published in Commodities

Is MSCI EM Status for PAKISTAN Likely ?

MSCI is considering a reclassification of Pakistani Equity market from Frontier to Emerging market status on 14th June 2016.

MSCI – A leading provider of research-based indexes and analytics, announced today that it will release on June 14, 2016, shortly after 11:00 p.m. Central European Summer Time (CEST), the results of the 2016 Annual Market Classification Review. As a reminder, three MSCI Country Indexes are currently included on the review list of the 2016 Annual Market Classification Review: MSCI China A and MSCI Pakistan Indexes for a potential reclassification to Emerging Markets and MSCI Peru Index for a potential reclassification to Frontier Markets.

It is important to note that MSCI is not the only index provider that classifies markets – but is considered the reference benchmark for many markets. MSCI and other index providers base their market classification on a number of quantitative measurable and comparative criteria while aiming to avoid qualitative and/ or subjective criteria.

PAKISTAN: ECONOMY IN FOCUS

Pakistan is a country with a population of 190 million people. Pakistan’s GDP stands at USD 250 Billion (Year 2015). Pakistan’s economy continued to pick up in the Fiscal Year 2015 as economic reform progressed and security improved. Inflation markedly declined, and the current deficit narrowed with favourable prices for oil and other commodities. Despite global headwinds, the outlook is for continued moderate growth as structural and macroeconomic reforms deepens.

| Selected economic indicators (%) – Pakistan | 2015 | 2016 Forecast | 2017 Forecast |

| GDP Growth | 4.2 | 4.5 | 4.8 |

| Inflation | 4.5 | 3.2 | 4.5 |

| Current Account Balance (share of GDP) | -1.0 | -1.0 | -1.2 |

CPEC : THE GAME CHANGER FOR PAKISTAN

China Pakistan economic corridor (CPEC) is a mega project of USD 46+ Billion taking the bilateral relationship between Pakistan and China to new heights. The project is the beginning of a journey of prosperity of Pakistan and China’s Xinjiang. The economic corridor is about 3000 Kilometers long consisting of Highways, Railways and Pipelines that will connect China’s Xinjiang province to the rest of the world through Pakistan’s Gwador port.

The investment on the corridor will transform Pakistan into a regional economic hub. The corridor will be a confidence booster for investors and attract investment not only from China but other parts of the world as well. Other than transportation infrastructure, the economic corridor will provide Pakistan with the telecommunications and energy infrastructure.

MSCI INDICES & PAKISTAN – A QUICK RECAP.

It is important to mention that Between 1994- 2008 Pakistan was part of the MSCI Emerging Markets Index. After the Balance of Payment crisis in 2008, KSE was shut down for 4 months after which the country was kicked out of the Emerging Markets Index. In May 2009 Pakistan was added back in the MSCI Index, but this time it was added in the Frontier Markets Index.

June last year MSCI put Pakistan up for official review regarding inclusion into Emerging Markets. Now as per today’s Press release MSCI will make its decision whether to upgrade or not on 14th of June.

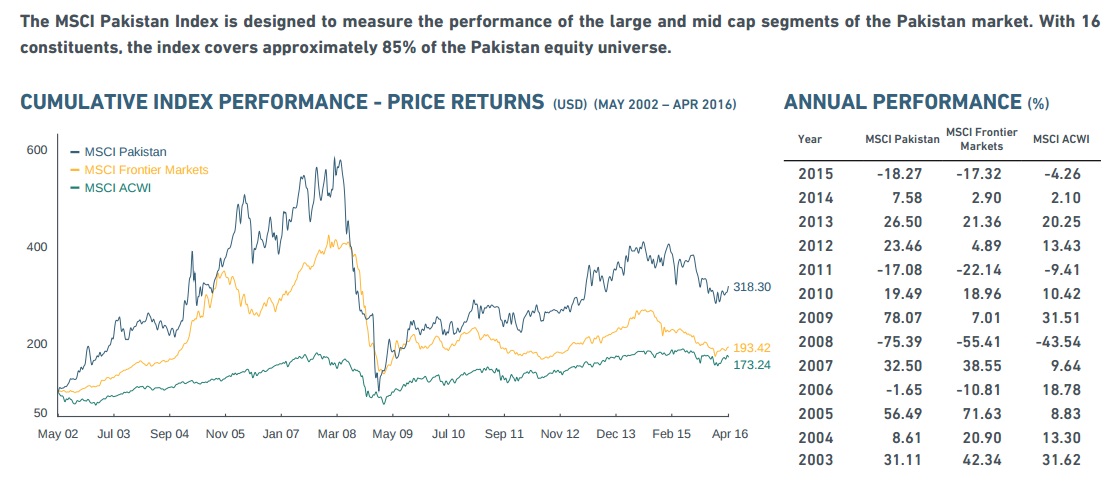

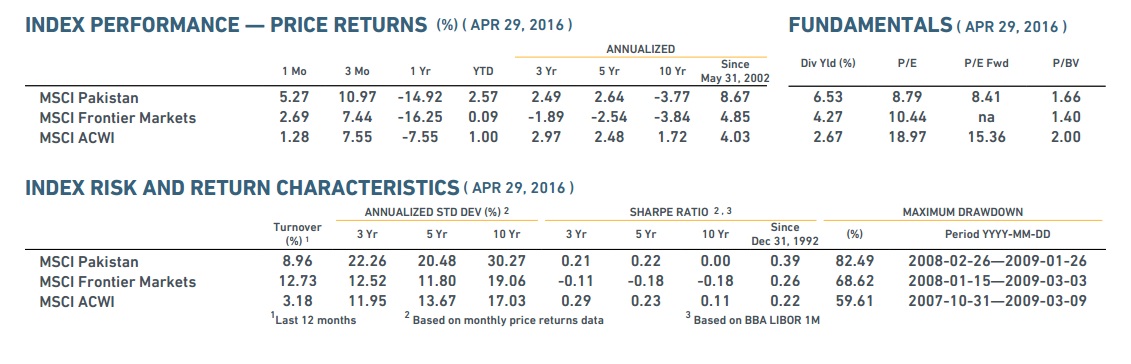

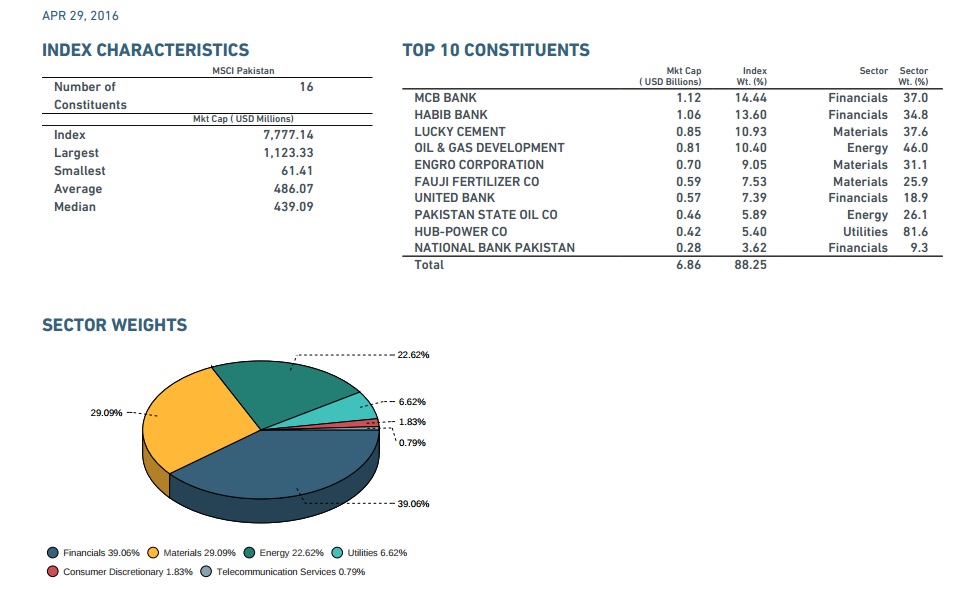

RECAP : THE MSCI PAKISTAN INDEX

INDEX METHODOLOGY:

The index is based on the MSCI Global Investable Indexes (GIMI) Methodology—a comprehensive and consistent approach to index construction that allows for meaningful global views and cross regional comparisons across all market capitalization size, sector and style segments and combinations. This methodology aims to provide exhaustive coverage of the relevant investment opportunity set with a strong emphasis on index liquidity, investability and replicability. The index is reviewed quarterly—in February, May, August and November—with the objective of reflecting change in the underlying equity markets in a timely manner, while limiting undue index turnover. During the May and November semi-annual index reviews, the index is rebalanced and the large and mid capitalization cutoff points are recalculated.

SOME IMPORTANT NUMBERS/STATS:

WHAT TO LOOK FOR IF PAKISTAN ENTERS MSCI EMERGING MARKETS INDEX ?

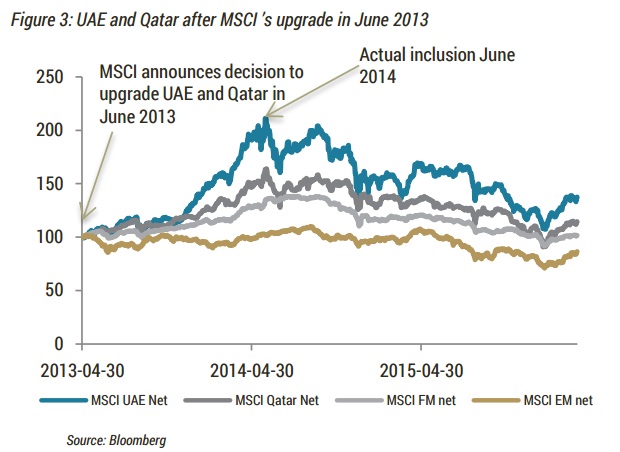

If the decision is positive Emerging Markets funds with 40-50 times the capital of Frontier funds will be forced to have a look at Pakistan. In our view this is an opportunity with a risk-reward skewed heavily towards the positive side.

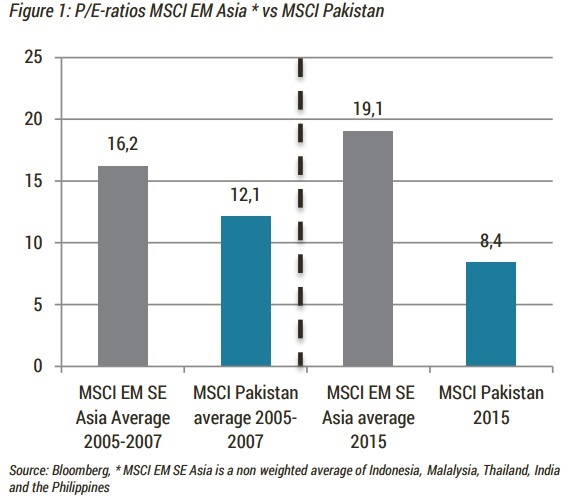

PSX currently trades at 9.0x earnings, companies have grown faster than their regional peers in USD over the last ten years. Should Pakistan enter MSCI Emerging Markets it does so at more than 40% P/E-discounts to its Asian EM peers. We don’t believe this is sustainable, hence calls for a re-rating of the valuations.

OUR STANCE:

We are of the view that it is likely that Pakistan will be given a Green Signal for entering MSCI Emerging Markets on 14th June 2016.

We caution against the notion that reclassification is a panacea for market ills or under-performance. Typically, reclassification (both upgrades and downgrades) have followed or been accompanied by economic and financial policy reforms, including improvements in market infrastructure. It is these more fundamental and structural reforms that attract and retain international investors and boost the confidence of domestic investors.

Re-classifications are best viewed as signaling a confirmation of policy reforms and changes in market conditions. Hence an identification problem may arise whereby improved market conditions are attributed to market reclassification decisions, whereas they are due to policy actions and reforms which lead to a reclassification. Similarly, we note that reclassification may have perverse effects if there is an ‘overshooting‘ effect whereby speculation leads to higher prices in advance of a reclassification, over and above what would be justified by market/ economic fundamentals. Prices then adjust on the actual reclassification event.

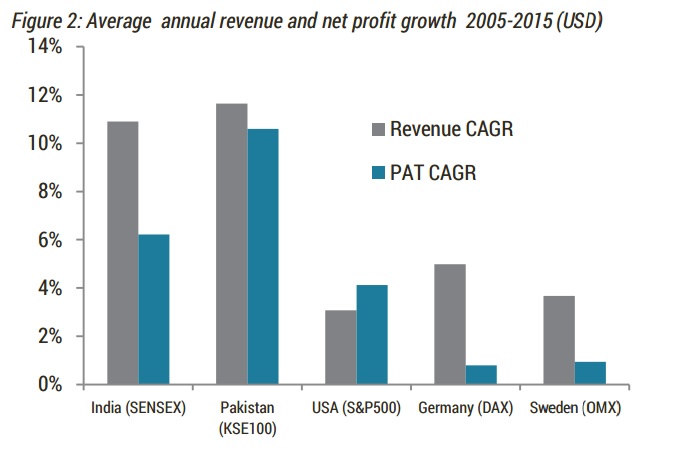

As highlighted in the article Average Annual Revenue and Net Profit Growth of companies listed in Pakistan have been phenomenal between Year 2005 – 2015. Moving forward with CPEC in place, Pakistan’s inclusion in MSCI Emerging Markets Index will be beneficial for both Local as well as Global Investors.

Research Team,

Shaikh Financial Services.

- Published in Stocks

FED Leaves Benchmark INTEREST RATES Unchanged.

As expected the Federal Reserve held the Fed Funds rate target unchanged at 0.25-0.5%. The vote was 9-1, with Kansas City Fed boss Esther George again dissenting from the hawkish side.

As for hints about June, the policy statement takes note of continuing strengthening in labor markets, but also of a moderation in household spending and inflation continuing to run below target.

SUMMARY:

No surprises from the Fed.

Global conditions upgrade.

Domestic growth downgrade.

Data Dependence persists.

No balance of risk assessment.

FOMC Details (27-04-2014) :

The FOMC delivered a statement largely as expected. It upgraded its assessment of the global economy by dropping the reference to risks. It downgraded its assessment of the domestic economy by acknowledging that growth has slowed.

Otherwise is general economic assessment remains little changed. The labor market continues to improve, though growth in household spending has slowed. Housing is stronger though fixed business investment and net exports have been soft (though not as soft as it looked before today’s advance reading of March merchandise trade balance that showed a sharp improvement that spurred some to revise up their forecasts for Q1 GDP due out tomorrow).

The Fed’s forward guidance has not changed. It is looking through the economic soft patch and expects the growth to strengthen. The Fed recognized that inflation is still below target, but as transitory factors subside, it expects to reach 2% in the medium term. The statement left no doubt that the central bank remains data dependent.

There was a little hint about its intentions for June, which follows logically from being data dependent. KC Fed President George repeated her March dissent favoring an immediate hike. The market is not buying it, however. The Fed funds futures continues to price in a small (~20%) chance of a June hike. The markets have whipsawed in response to the statement which helps no surprises.

In addition to not being convinced about the recovery of the domestic economy, many are concerned that global considerations may deter the Fed from hiking in June. The UK referendum takes place a week later. Spain has a do-over election after the vote last December failed to produce a government. European tensions with Greece are on the rise. MSCI Emerging Market equity index has rallied more than 25% since January. Oil is up 70% from its lows. Neither move looks likely to be repeated over the next couple of months.

The Fed’s decision to stand pat here in April, when there was no press conference scheduled, is unlikely to play a significant role in the decisions of other central banks, including the Bank of Japan tomorrow. We earlier argued that the FOMC statement was unlikely to add substantially to investors and policymakers information set. This seems to be very much the case.

Research Team,

Shaikh Financial Services

- Published in Stocks

Oil Prices: The Global Scenario

The oil industry, with its history of booms and busts, is in its deepest downturn since the 1990s, if not earlier.

Earnings are down for companies that made record profits in recent years, leading them to decommission more than two-thirds of their rigs and sharply cut investment in exploration and production. Scores of companies have gone bankrupt and an estimated 250,000 oil workers have lost their jobs.

The cause is the plunging price of a barrel of oil, which has fallen more than 70 percent since June 2014.

Prices recovered a few times over the last year, but the cost of a barrel of oil has already sunk this year to levels not seen since 2003 as an oil glut has taken hold.

Also contributing to the glut was Iran’s return to the international oil market after sanctions were lifted against the country under an international agreement with major world powers to restrict its nuclear work that took effect in January.

What is the current price of Oil?

Brent crude, the main international benchmark, is trading around $39 a barrel, where as the American benchmark WTI is at around $38 a barrel.

Why has the price of Oil been dropping? Why Now?

This a complicated question, but it boils down to the simple economics of supply and demand.

United States domestic production has nearly doubled over the last several years, pushing out oil imports that need to find another home. Saudi, Nigerian and Algerian oil that once was sold in the United States is suddenly competing for Asian markets, and the producers are forced to drop prices. Canadian and Iraqi oil production and exports are rising year after year. Even the Russians, with all their economic problems, manage to keep pumping.

There are signs, however, that production is falling because of the drop in exploration investments. RBC Capital Markets has calculated projects capable of producing more than a half million barrels a day of oil were cancelled, delayed or shelved by OPEC countries alone last year, and this year promises more of the same.

But the drop in production is not happening fast enough, especially with output from deep waters off the Gulf of Mexico and Canada continuing to build as new projects come online.

On the demand side, the economies of Europe and developing countries are weak and vehicles are becoming more energy-efficient. So demand for fuel is lagging a bit.

Who benefits from the price drops?

The biggest winner of Low Oil prices are Oil Importing countries, as their import bills have reduced significantly.

Who Loses?

For starters, oil-producing countries and states. Venezuela, Nigeria, Ecuador, Brazil and Russia are just a few petrostates that are suffering economic and perhaps even political turbulence.

The impact of Western sanctions caused Iranian production to drop by about one million barrels a day in recent years and blocked Iran from importing the latest Western oil field technology and equipment. With sanctions now being lifted, the Iranian oil industry is expected to open the taps on production soon.

In the United States, there are now virtually no wells that are profitable to drill.

Chevron, Royal Dutch Shell and BP have all announced cuts to their payrolls to save cash, and they are in far better shape than many smaller independent oil and gas producers.

States like Alaska, North Dakota, Texas, Oklahoma and Louisiana are facing economic challenges.

There has also been an uptick in traffic deaths as low gas prices have translated to increased road travel. And many young Saudis have seen cushy jobs vanish.

What are the New challenges for producers ?

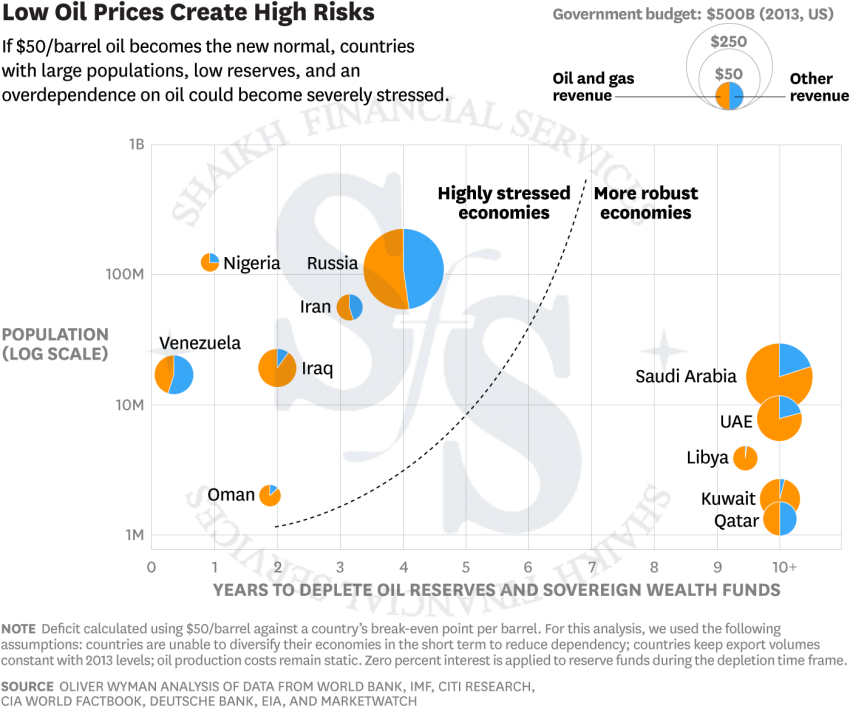

Depending on how nations react, a lower per-barrel oil price could result in a new balance of power in the oil industry. We recently conducted a study to test the impact of sustained $50 oil on oil-producing countries. The results showed that $50 oil puts some producing countries under considerable stress as they grapple with less oil revenue in their national budgets. Venezuela, Nigeria, Iraq, Iran, and Russia could be forced to address substantial budget deficits within the next five years.

Gulf Cooperation Council (GCC) producers such as Saudi Arabia, the United Arab Emirates, Kuwait, and Qatar have amassed considerable wealth during the past decade through cash reserves and sovereign wealth funds. But even these countries could come under stress in the next decade if they continue to follow their status quo.

Depending on how nations react, a lower per-barrel oil price could result in a new balance of power in the oil industry. We recently conducted a study to test the impact of sustained $50 oil on oil-producing countries. The results showed that $50 oil puts some producing countries under considerable stress as they grapple with less oil revenue in their national budgets. Venezuela, Nigeria, Iraq, Iran, and Russia could be forced to address substantial budget deficits within the next five years.

Gulf Cooperation Council (GCC) producers such as Saudi Arabia, the United Arab Emirates, Kuwait, and Qatar have amassed considerable wealth during the past decade through cash reserves and sovereign wealth funds. But even these countries could come under stress in the next Five years if they continue to follow their status quo.

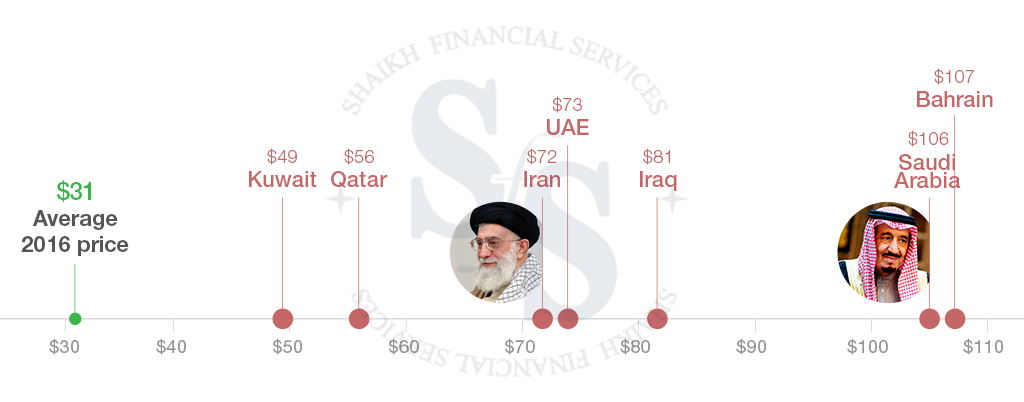

Cheap Oil is crushing which Middle Eastern Countries?

Saudi Arabia, Qatar and Iran rely on oil exports. Oil under $49 a barrel is already below the break-even point for many middle eastern nations’ budgets, which means current prices are really hurting.

The Illustration below shows the Break Even Point for Middle Eastern Countries’ Budget. Source: IMF

What happened to OPEC?

Iran, Venezuela, Ecuador and Algeria have all pressed OPEC, a cartel of oil producers, to cut production to firm up prices. At the same time, Iraq is actually pumping more, and Iran is expected to become a major exporter again.

Major producing countries will meet on April 17 in Qatar, and some analysts think a cut may be possible, especially if oil prices approach $30 a barrel again.

King Salman, who assumed power in Saudi Arabia in January 2015, may find it difficult to persuade other OPEC members to keep steady against the financial strains, even if Iran continues to increase production. The International Monetary Fund estimates that the revenues of Saudi Arabia and its Persian Gulf allies will slip by $300 billion this year.

Is there a Conspiracy to bring the price of Oil down?

There are a number of conspiracy theories floating around. Even some oil executives are quietly noting that the Saudis want to hurt Russia and Iran, and so does the United States — motivation enough for the two oil-producing nations to force down prices. Dropping oil prices in the 1980s did help bring down the Soviet Union, after all.

But there is no evidence to support the conspiracy theories, and Saudi Arabia and the United States rarely coordinate smoothly. And the Obama administration is hardly in a position to coordinate the drilling of hundreds of oil companies seeking profits and answering to their shareholders.

What are the Oil & Gas revenues for some top Oil producing countries?

When are Oil prices likely to recover?

Oil markets have bounced back more than 40 percent since hitting a low of $26.21 a barrel in New York in early February. Moving ahead prices are likely to remain highly volatile, hence creating trading opportunities both on LONG and SHORT Side for smart Technical Analysts.

Research Team,

Shaikh Financial Services

- Published in Commodities

Center for International Development at Harvard University predicts 5% Economic Growth in Pakistan for next 10 years.

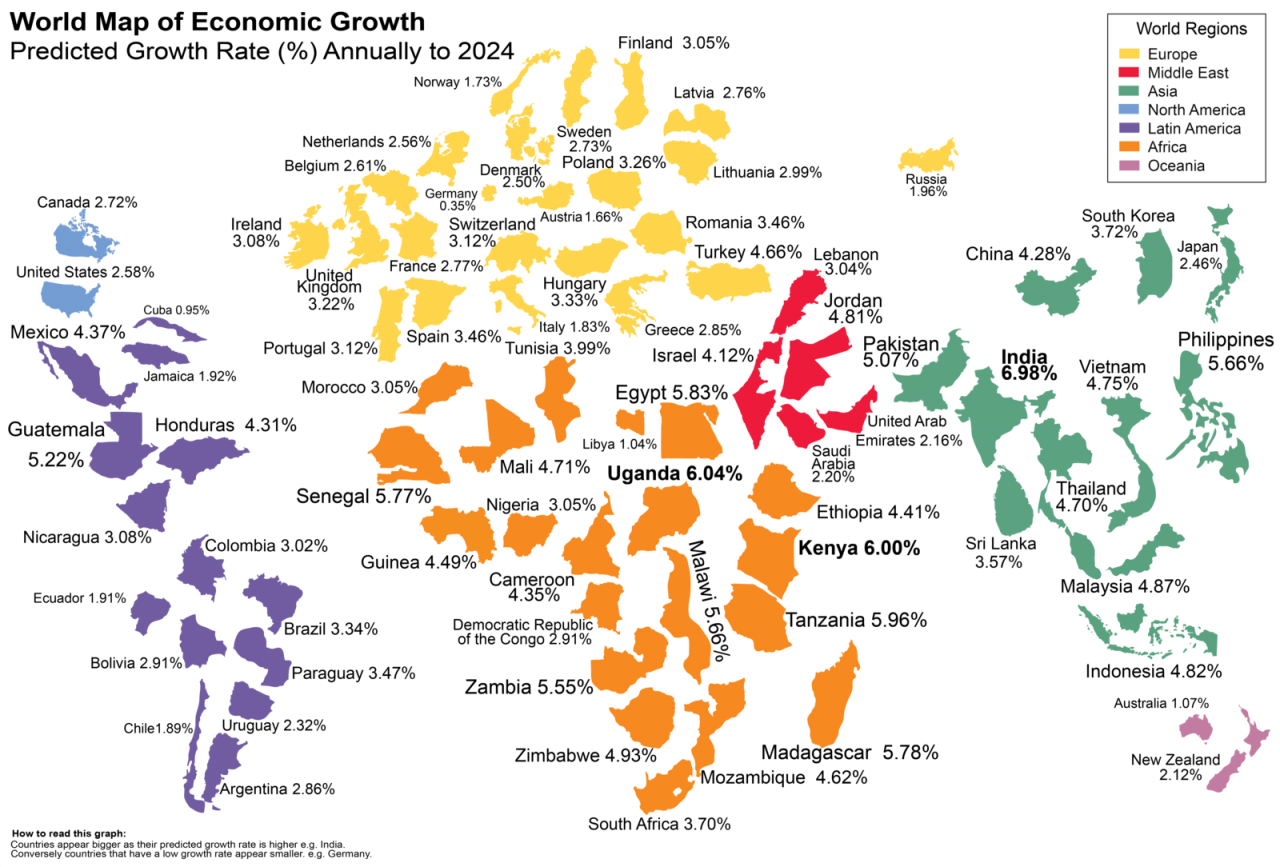

Pakistan’s predicted annual growth rate for the next 10 years is 5.07%.

Experts have predicted that India may be the fastest growing global economy in the next decade. The Center for International Development at Harvard University (CID) is using a newly updated measure of economic complexity to forecast an annual growth rate of 6.98% for India over the next decade. The CID believes that the countries with the greatest potential for growth are located mainly in South Asia and East Africa.

We created the following scaled map to show the forecasted growth rates. The countries are scaled according to their predicted growth rate. Thus, India appears larger than the United States with a predicted growth rate of only 2.58%.

As can be seen from the map, India appears larger on the map than its neighbor China to the north. The CID believes that India will have the highest growth rate because of gains in productive capabilities. These gains have allowed the country to diversify exports into more complex products such as pharmaceuticals, vehicles and electronics. Historically, gains in economic complexity have resulted in higher incomes.

There are a number of countries in East Africa that are projected to grow at least 5.5% annually. Five countries in the region appear on the top ten of the CID list including Uganda, Tanzania, Kenya, Malawi and Madagascar. In addition, there are countries in both the Middle East and South America that appear poised to take off. Jordan and Israel have projected annual growth rates in excess of 4%. Guatemala has a projected growth rate of 5.22%, while Honduras and Mexico are both over 4%.

At the same time, economic growth is anticipated to slow in advanced economies. The U.S. is anticipated to only grow 2.58%. The U.K. is forecasted at a slightly higher 3.22%. Germany, one of the leading economies in Europe, is forecasted with an annual growth rate of only 0.35%. The CID also notes that economies based on commodity output face slower growth rates as commodity prices continue to remain under pressure.

The CID uses economic complexity as their indicator for economic growth after a decade of research. This research has found countries that diversify their production knowledge beyond what is expected see faster income growth. This is a much more accurate indicator of future growth as compared with the popular World Economic Forum Global Competitiveness Index. For example, the CID says that Greece has been an outlier for having a higher income level than would be expected for its level of economic complexity. The country has struggled with average negative annual growth over the past decade.

The CID says that looking at economic complexity may help policymakers. By finding ways to bring new production and product capability into a country, it could help to strengthen growth in the future. The key is getting the new knowledge to come into the area which depends in part on immigration policy, as well as education policy.

About the Center for International Development

The Center for International Development (CID) at Harvard University is a university-wide center that works to advance the understanding of development challenges and offer viable solutions to problems of global poverty. CID is Harvard’s leading research hub focusing on resolving the dilemmas of public policy associated with generating stable, shared, and sustainable prosperity in developing countries. Our ongoing mission is to apply knowledge to and revolutionize the world of development practice.

Research Team,

Shaikh Financial Services

- Published in Stocks

India Will Be the Fastest Growing Economy for Coming Decade.

It’s already expected to have been the world’s fastest-growing economy in 2015. But India also has the best growth prospects for the coming decade, based on the increasing variety and sophistication of the products it exports.

In new forecasts by economists led by Ricardo Hausmann at Harvard University’s Center for International Development, India’s 7% projected annual growth rate through 2024 would continue to put it ahead of China, where similar advances in productive know-how propelled the country’s rise over the past decade but are now closer to being exhausted.

China’s output growth is forecast to be just 4.3% a year on average for the next decade. Meanwhile, East African countries like Uganda, Tanzania and Kenya are projected to grow at around 6%. Several Southeast Asian countries also fare well in the forecasts: The Philippines, Malaysia, Indonesia and Vietnam are expected to see expansion of between 4.75% and 5.7%.

The economists’ predictions are based on research that suggests a country’s prosperity is most consistently determined, not by political institutions, years of schooling or the ease of doing business, but by the ability to make stuff that few others can.

This kind of collective knowledge is captured by measures, developed by Mr. Hausmann and others, of “economic complexity.” Nations that export a wide range of advanced products—everything from jet engines to medicines to soybeans—score highly on these, whereas those that produce a few, largely ubiquitous items—such as cotton, crude oil or sesame seeds—do not.

If a country’s per-capita income is low relative to others at a similar level of complexity, then that suggests there is opportunity to grow and catch up. In India, average incomes are nearer to Sub-Saharan African levels than to East Asian ones, yet the country has built up world-class companies that export pharmaceuticals, autos and auto parts, petroleum products and more.

The other side of the coin is that more-advanced countries are less likely to diversify further. Germany, an innovative industrial powerhouse, was found to be the world’s second-most complex economy, according to 2014 trade data. But that is partly why its projected annual growth rate through 2024 is just 0.35%, below Cuba’s and Libya’s. U.S. growth is predicted to be 2.6%.

Economic expansion, in this model, is also harder in nations that are relatively rich despite being fundamentally limited in productive capability. Greece is in this category, as are countries dependent on mineral wealth: Venezuela, Qatar, Russia, Saudi Arabia.

One limitation of the Harvard research is that it only uses data on trade in goods. Services such as business outsourcing, finance and software constitute a growing share of countries’ productive knowledge and output, not least in India.

About the Center for International Development

The Center for International Development (CID) at Harvard University is a university-wide center that works to advance the understanding of development challenges and offer viable solutions to problems of global poverty. CID is Harvard’s leading research hub focusing on resolving the dilemmas of public policy associated with generating stable, shared, and sustainable prosperity in developing countries. Our ongoing mission is to apply knowledge to and revolutionize the world of development practice.

Research Team,

Shaikh Financial Services

- Published in General

A Dutch dairy cooperative (Friesland Campina International) interested in buying 51% shares of EFOODS from ENGRO Corp.

Engro Corp (ENGRO) has received a public announcement of intention to acquire up to 51% of ENGRO’s shareholding in Engro Foods Limited (EFOODS), amounting to ~340mn shares, by FrieslandCampina International Holding BV, a Dutch dairy cooperative.

ENGRO currently has a 667mn shares stake in EFOODS. Due diligence with regards to the share purchase is expected to commence shortly. The impact of the transaction will be material on ENGRO, resulting in a cash inflow of approx PKR57bn (at an assumed strike price of PKR154/sh) coupled with a gain of approx PKR93/sh.

We believe the gain will be recognized in the consolidated books given loss of ENGRO’s control over EFOODS post execution of the transaction. Post sell-off, the effective shareholding of ENGRO will reduce to 327mn shares (43% of the total shares).

Proceeds generated through selling may potentially be deployed in expansion of Sindh Engro Coal Mining Company (SECMC) and Engro Powergen Thar.

If this deal is materialized, it will be the largest ever deal in the private sector history of Pakistan.

Pakistan is already in the radar range of the world corporate sector and this deal will further lift its image.

Note: FrieslandCampina is the world’s largest dairy cooperative and one of the top 5 dairy companies in the world.

SFS Research

- Published in Stocks

KSE-100 : Market View

Today, KSE-100 Index is trading around the 31,000 level mark.

We are Extremely BULLISH on the index, hence we are giving a STRONG BUY call.

We believe before june 2016, we will see a new ALL time High.

NOTE: HOLD your nerves, Don’t panic, Inshallah we will see a New All time high very soon.

HOLD ALL YOUR STOCKS which we have bought/accumulated in last 3 days.

BEST OF LUCK.

Research Team,

Shaikh Financial Services.

- Published in Stocks

CRUDE OIL: SFS TRADE CALL

Last year we gave a ‘’FREE to ALL’’ – SHORT SELL Call for investors when Crude Oil was trading above $60/barrel. Since then Crude Oil has been under severe selling pressure. Recently crude touched $26/Barrel (The Lowest Price So Far for the year 2016). Below is the Snapshot of our previous FREE TO ALL – SHORT SELL Call made last year.

Right Now Crude Oil is trading around $29/Barrel.

We ask everyone to close his/her Crude Oil SHORT SELL position, which was initiated on our call when crude was trading above $60/Barrel.

OUR LATEST CALL:

We are NOW giving a STRONG BUY CALL for CRUDE OIL which is trading around the $29/Barrel with a strict Stop Loss at $24.60. Our Projected Target is $46.80, which we expect will be achieved before June end this year. Inshallah

When the whole world including Bank of America, Goldman Sachs, Merrill Lynch is giving away CALLS of $20/Barrel for Crude, Our Company Shaikh Financial Services is the first one to give a BUY Call for Crude Oil.

ALMIGHTY ALLAH has been very kind, he has kept our IZAT before, and we are 100% sure he will again Keep our IZAT. Inshallah.

BEST OF LUCK.

Research Team,

Shaikh Financial Services.

- Published in Commodities

GOLD: Target Price Update

Target Price Update for INVESTORS:

On 29th Jan 2016, We gave a BUY call of GOLD at 1110, Stop Loss 1080, Target Price 1210.

Today GOLD is trading around 1195/Oz, just within the reach of our Target price.

We are now updating our Target Price to 1290/Oz.

Stop Loss is also raised from 1080 to 1140/Oz.

We are expecting that our target price of 1290/oz will be achieved before JUNE end. Inshallah.

NOTE: This Analysis if for INVESTORS Only, HIGH RISK Traders are requested to do swing trading on our trading calls, received on their cell phones on daily basis.

BEST OF LUCK.

Research Team,

Shaikh Financial Services.

- Published in Commodities