Bitcoin: What’s Next ?

Bitcoin is currently trading at $11,500, below the major resistance of $12,500.

We believe prices are going to reverse from here, without breaking the all-important $12,500 mark.

Price reversal towards at-least $10,000 seems likely. Sustained Break below $9800 has the potential to drag the prices much lower. On the other hand, any sustained move above the $12,500 level will favour the BULLS, otherwise BEARS still hold an edge.

- Published in Commodities

Bitcoin Trade Call Update.

Bitcoin recently made a low of $9200 and is in the recovering mode. Current Prices are hovering around the $11,600 mark. As per our technical analysis, we are considering this price move as a Dead Cat Bounce and we believe downtrend will resume very soon & this time it will even break the $8700 level mark and later we might even see $7000.

Hold your nerves, Add few more SHORT Position on any price strength with Stop-Loss at $14,500, keeping in view the targets of $8700 & $7000.

Best of Luck

Note: This Post is with reference to our earlier post titled Bitcoin -Top In The Making.

- Published in Commodities

Bitcoin: TOP In The Making, Free Exclusive Trade Call

Bitcoin is currently trading just under the $20,000 mark (Current Price $19,400).

Technically this parabolic move is way too stretched & it is more likely that the Top of this move is going to be somewhere in-between 19,500 – 22,500.

We are giving a SHORT SELL Call at the current Price of $19,400 with a Stop-Loss at 22,700.

Our Very Short Term Target is $15,400, then later $12,200 & Finally $8700.

We are of the view that $8700 will be achieved within next few weeks or so.

Keep SHORT Positions till the time this target of $8700 is achieved.

Once price starts to decline adjust your stop-loss according to your risk taking capacity. Generally speaking if and when price comes down to $15,400, move your stop-loss to $ 18,400.

Note : We believe that Big Boys of Wall Street will be in action (by SHORT-SELLING Bitcoin) as Bitcoin Futures Trading Begins at CME.

Best Of Luck.

- Published in Commodities

Gold Update: Free Trade Call

We gave a Buy call at 1213/Oz few days back. Gold is currently trading at 1283, Close your BUY positions which were initiated on our call and book $70/oz Profit.

Swing Trading Entry:

SHORT SELL Gold at current rate of 1283/82 with a target of 1263. Place Stop-Loss at 1292.

Hope you enjoyed our FREE trading Call.

You are requested to Remember us in your prayers.

Note: To become our client & to get daily trade calls, contact us for details.

Research Team,

Shaikh Financial Services.

- Published in Commodities

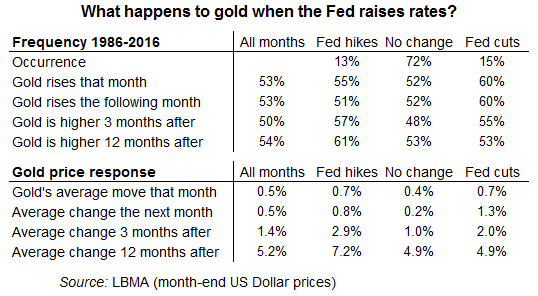

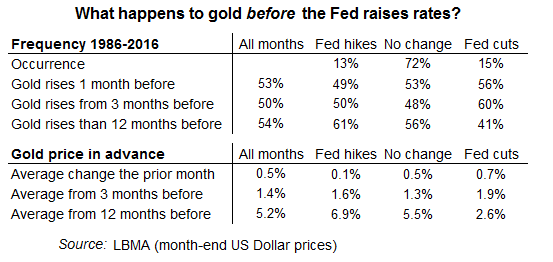

Impact of FED’s Interest Rate Decision on Gold Prices.

Although theory says that gold price should decline after an interest rate hike and it should increase after an interest rate cut, history shows that this anticipation is often wrong. The Gold market always try to predict the future development, and the interest rate change is often reflected by the prices before the rate change itself is officially announced. If there was a strong trend before the rate change, the trend may get disrupted for some time, although it tends to resume after the dust settles down.

It’s a fact that making money from financial trading means getting ahead of the move, buying before an asset goes up and selling it before it goes down. So if gold should fall when Fed rates go up – like everyone thinks, because it pays no income and so carries an opportunity cost in the form of lost interest on cash – then no one should want to wait. Sell early, provided you’re sure you know which way the Fed will go.

The story is that selling in advance works to depress gold prices before the Fed makes its announcement (just like buying before a rate cut pushes it higher). Brought forward in time, this self-fulfillment cracks open a gap between what intuitions says gold should do when the Fed raises (or cuts) and what actually happens after the fact.

Gold had first failed to reclaim that peak in 2012 when the Fed expanded its quantitative easing bond-buying program to $85 billion per month. Then gold sank in 2013 (as now ex-chairman Ben Bernanke muttered about ‘tapering’ QE) before steadying in 2014 (even as the taper became fact) only to slide again in 2015 (as Janet Yellen muttered time and again that her committee would, like, really really raise rates from zero before the end of last year).

The Fed squeezed its first hike into 2015, but only just! ‘Will they? When?’ finally ended, gold prices have barely looked back, marking 2016 with the strongest half-annual gains since the financial crisis broke in 2008. The Federal Reserve’s first interest-rate hike after 7 years stuck at zero last December finally put gold out of its misery. Marking a new 6-year low, gold prices hit $1046 per ounce straight after the Fed rate rise. A 27% jump came as the Fed failed to follow up with a second rate hike, never mind the two or three needed by September to keep the central bank’s own 2016 forecast on track. This is now the longest “pause” in any modern interest-rate cycle. Even if the Fed does raise at this week’s meeting, it begs the question whether this qualifies as a rate-hiking cycle. The Fed never waited so long as it did in 2009-2015 before making a change to rates. It has never now hemmed and hawed this long before following one rise with another.

Still, gold prices have softened over the summer, easing $50 per ounce from the 2-year Dollar peak of $1375 hit immediately after the UK’s Brexit referendum shock. Desperate as always for a narrative of ‘this plus that equals the other’, financial newswires and traders put gold’s retreat entirely down to Fed chit-chat – because some Fed members have switched to calling for a second rate rise sooner, rather than later, fretting about unintended consequences from today’s near-record low ceiling of 0.50%.

Well, go on then Janet, Stanley, Lael and the rest. Gold dares you.

Research Desk,

Shaikh Financial Services

- Published in Commodities

BREXIT will Happen, Black FRIDAY on the Cards.

BLACK FRIDAY IN THE MAKING:

Since last 4 months i am of the opinion that BREXIT will happen.

Now it’s time to take few entries in the Financial Markets based on our prediction that BREXIT will happen.

GBPUSD: Sterling currently is trading around 1.4950.

Everyone should SHORT-SELL the Hell out of it. Place your Stop-Loss at 1.5300. Target is 1.3450.

Note: If the trade comes out right we will be able to book a profit of 1500 pips within 24-36 hrs, otherwise we will loose 350 pips. The Risk and Reward Ratio is perfect and technically i am confident that our target will be achieved.

——————————————————————————————————————-

GOLD: Gold is currently hovering around 1265/Oz.

We are BUYING gold at current price of 1265, Stop-Loss should be placed at 1240 and Target should be 1345/Oz.

——————————————————————————————————————-

CRUDE OIL: Crude Oil is trading at around 50.30/Brl.

We will not take any Position in CRUDE OIL at the moment, but for your guidance, i would like to comment that Crude will take a hit and will decline on BREXIT.

——————————————————————————————————————-

STOCKS:

Stocks Markets all across the Globe will take a severe beating, specially DOW, FTSE, NIKKEI.

& Yes PSX will also take a hit.

Just to Recall, We had already liquidated All our PSX holdings last week, which were bought at 31,000 index level few months back. We will be coming out with a New PSX Strategy over the weekend.

——————————————————————————————————————-

NOTE: At the moment, We don’t need to take position in everything, we will just take positions in GBPUSD and GOLD.

Once these 2 trades are complete, all of you will be guided via WhatsApp about the next Strategy.

Wishing you all the very best,

Raheel Shaikh.

- Published in Commodities, Stocks

GOLD: Swing Trade Alert !!

Current Gold Price: 1215/Oz

We closed our GOLD Long Positions at 1290/Oz few days back, which we initiated at 1110/Oz, booking a whooping gain of 180/Oz.

Now we initiate a New BUY Position in Gold at current rate of 1215/Oz.

Stop-Loss should be placed at 1195 & Target Price of 1290/Oz.

** Once Prices Reaches 1290, we will Whatsapp a new updated strategy to all of you.

NOTE: Daily Strategy will be sent as per routine on your Mobile Numbers, It should not be mixed with this Trade Entry.

Research Team,

Shaikh Financial Services

- Published in Commodities

Oil Prices: The Global Scenario

The oil industry, with its history of booms and busts, is in its deepest downturn since the 1990s, if not earlier.

Earnings are down for companies that made record profits in recent years, leading them to decommission more than two-thirds of their rigs and sharply cut investment in exploration and production. Scores of companies have gone bankrupt and an estimated 250,000 oil workers have lost their jobs.

The cause is the plunging price of a barrel of oil, which has fallen more than 70 percent since June 2014.

Prices recovered a few times over the last year, but the cost of a barrel of oil has already sunk this year to levels not seen since 2003 as an oil glut has taken hold.

Also contributing to the glut was Iran’s return to the international oil market after sanctions were lifted against the country under an international agreement with major world powers to restrict its nuclear work that took effect in January.

What is the current price of Oil?

Brent crude, the main international benchmark, is trading around $39 a barrel, where as the American benchmark WTI is at around $38 a barrel.

Why has the price of Oil been dropping? Why Now?

This a complicated question, but it boils down to the simple economics of supply and demand.

United States domestic production has nearly doubled over the last several years, pushing out oil imports that need to find another home. Saudi, Nigerian and Algerian oil that once was sold in the United States is suddenly competing for Asian markets, and the producers are forced to drop prices. Canadian and Iraqi oil production and exports are rising year after year. Even the Russians, with all their economic problems, manage to keep pumping.

There are signs, however, that production is falling because of the drop in exploration investments. RBC Capital Markets has calculated projects capable of producing more than a half million barrels a day of oil were cancelled, delayed or shelved by OPEC countries alone last year, and this year promises more of the same.

But the drop in production is not happening fast enough, especially with output from deep waters off the Gulf of Mexico and Canada continuing to build as new projects come online.

On the demand side, the economies of Europe and developing countries are weak and vehicles are becoming more energy-efficient. So demand for fuel is lagging a bit.

Who benefits from the price drops?

The biggest winner of Low Oil prices are Oil Importing countries, as their import bills have reduced significantly.

Who Loses?

For starters, oil-producing countries and states. Venezuela, Nigeria, Ecuador, Brazil and Russia are just a few petrostates that are suffering economic and perhaps even political turbulence.

The impact of Western sanctions caused Iranian production to drop by about one million barrels a day in recent years and blocked Iran from importing the latest Western oil field technology and equipment. With sanctions now being lifted, the Iranian oil industry is expected to open the taps on production soon.

In the United States, there are now virtually no wells that are profitable to drill.

Chevron, Royal Dutch Shell and BP have all announced cuts to their payrolls to save cash, and they are in far better shape than many smaller independent oil and gas producers.

States like Alaska, North Dakota, Texas, Oklahoma and Louisiana are facing economic challenges.

There has also been an uptick in traffic deaths as low gas prices have translated to increased road travel. And many young Saudis have seen cushy jobs vanish.

What are the New challenges for producers ?

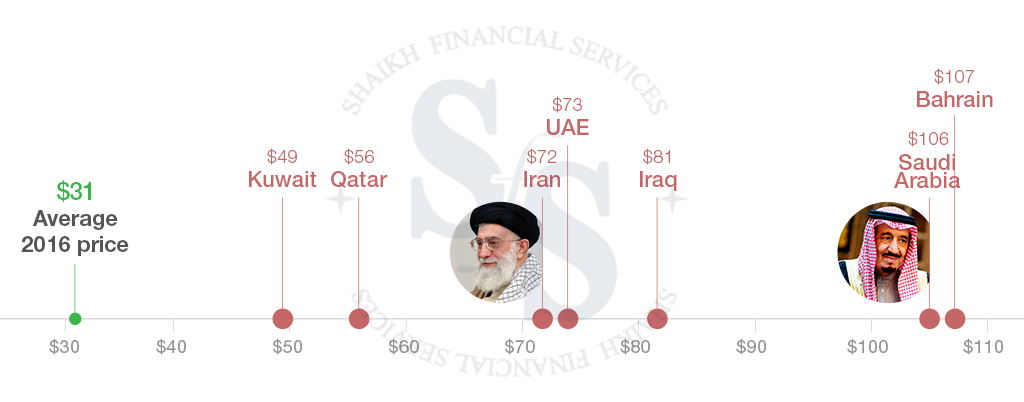

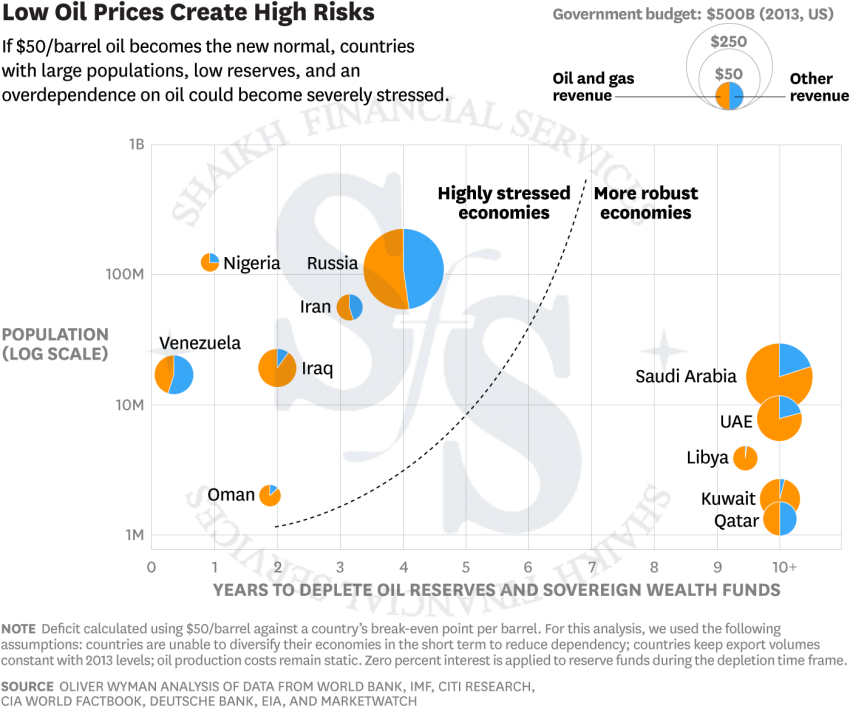

Depending on how nations react, a lower per-barrel oil price could result in a new balance of power in the oil industry. We recently conducted a study to test the impact of sustained $50 oil on oil-producing countries. The results showed that $50 oil puts some producing countries under considerable stress as they grapple with less oil revenue in their national budgets. Venezuela, Nigeria, Iraq, Iran, and Russia could be forced to address substantial budget deficits within the next five years.

Gulf Cooperation Council (GCC) producers such as Saudi Arabia, the United Arab Emirates, Kuwait, and Qatar have amassed considerable wealth during the past decade through cash reserves and sovereign wealth funds. But even these countries could come under stress in the next decade if they continue to follow their status quo.

Depending on how nations react, a lower per-barrel oil price could result in a new balance of power in the oil industry. We recently conducted a study to test the impact of sustained $50 oil on oil-producing countries. The results showed that $50 oil puts some producing countries under considerable stress as they grapple with less oil revenue in their national budgets. Venezuela, Nigeria, Iraq, Iran, and Russia could be forced to address substantial budget deficits within the next five years.

Gulf Cooperation Council (GCC) producers such as Saudi Arabia, the United Arab Emirates, Kuwait, and Qatar have amassed considerable wealth during the past decade through cash reserves and sovereign wealth funds. But even these countries could come under stress in the next Five years if they continue to follow their status quo.

Cheap Oil is crushing which Middle Eastern Countries?

Saudi Arabia, Qatar and Iran rely on oil exports. Oil under $49 a barrel is already below the break-even point for many middle eastern nations’ budgets, which means current prices are really hurting.

The Illustration below shows the Break Even Point for Middle Eastern Countries’ Budget. Source: IMF

What happened to OPEC?

Iran, Venezuela, Ecuador and Algeria have all pressed OPEC, a cartel of oil producers, to cut production to firm up prices. At the same time, Iraq is actually pumping more, and Iran is expected to become a major exporter again.

Major producing countries will meet on April 17 in Qatar, and some analysts think a cut may be possible, especially if oil prices approach $30 a barrel again.

King Salman, who assumed power in Saudi Arabia in January 2015, may find it difficult to persuade other OPEC members to keep steady against the financial strains, even if Iran continues to increase production. The International Monetary Fund estimates that the revenues of Saudi Arabia and its Persian Gulf allies will slip by $300 billion this year.

Is there a Conspiracy to bring the price of Oil down?

There are a number of conspiracy theories floating around. Even some oil executives are quietly noting that the Saudis want to hurt Russia and Iran, and so does the United States — motivation enough for the two oil-producing nations to force down prices. Dropping oil prices in the 1980s did help bring down the Soviet Union, after all.

But there is no evidence to support the conspiracy theories, and Saudi Arabia and the United States rarely coordinate smoothly. And the Obama administration is hardly in a position to coordinate the drilling of hundreds of oil companies seeking profits and answering to their shareholders.

What are the Oil & Gas revenues for some top Oil producing countries?

When are Oil prices likely to recover?

Oil markets have bounced back more than 40 percent since hitting a low of $26.21 a barrel in New York in early February. Moving ahead prices are likely to remain highly volatile, hence creating trading opportunities both on LONG and SHORT Side for smart Technical Analysts.

Research Team,

Shaikh Financial Services

- Published in Commodities

CRUDE OIL: SFS TRADE CALL

Last year we gave a ‘’FREE to ALL’’ – SHORT SELL Call for investors when Crude Oil was trading above $60/barrel. Since then Crude Oil has been under severe selling pressure. Recently crude touched $26/Barrel (The Lowest Price So Far for the year 2016). Below is the Snapshot of our previous FREE TO ALL – SHORT SELL Call made last year.

Right Now Crude Oil is trading around $29/Barrel.

We ask everyone to close his/her Crude Oil SHORT SELL position, which was initiated on our call when crude was trading above $60/Barrel.

OUR LATEST CALL:

We are NOW giving a STRONG BUY CALL for CRUDE OIL which is trading around the $29/Barrel with a strict Stop Loss at $24.60. Our Projected Target is $46.80, which we expect will be achieved before June end this year. Inshallah

When the whole world including Bank of America, Goldman Sachs, Merrill Lynch is giving away CALLS of $20/Barrel for Crude, Our Company Shaikh Financial Services is the first one to give a BUY Call for Crude Oil.

ALMIGHTY ALLAH has been very kind, he has kept our IZAT before, and we are 100% sure he will again Keep our IZAT. Inshallah.

BEST OF LUCK.

Research Team,

Shaikh Financial Services.

- Published in Commodities

GOLD: Target Price Update

Target Price Update for INVESTORS:

On 29th Jan 2016, We gave a BUY call of GOLD at 1110, Stop Loss 1080, Target Price 1210.

Today GOLD is trading around 1195/Oz, just within the reach of our Target price.

We are now updating our Target Price to 1290/Oz.

Stop Loss is also raised from 1080 to 1140/Oz.

We are expecting that our target price of 1290/oz will be achieved before JUNE end. Inshallah.

NOTE: This Analysis if for INVESTORS Only, HIGH RISK Traders are requested to do swing trading on our trading calls, received on their cell phones on daily basis.

BEST OF LUCK.

Research Team,

Shaikh Financial Services.

- Published in Commodities

- 1

- 2