The oil industry, with its history of booms and busts, is in its deepest downturn since the 1990s, if not earlier.

Earnings are down for companies that made record profits in recent years, leading them to decommission more than two-thirds of their rigs and sharply cut investment in exploration and production. Scores of companies have gone bankrupt and an estimated 250,000 oil workers have lost their jobs.

The cause is the plunging price of a barrel of oil, which has fallen more than 70 percent since June 2014.

Prices recovered a few times over the last year, but the cost of a barrel of oil has already sunk this year to levels not seen since 2003 as an oil glut has taken hold.

Also contributing to the glut was Iran’s return to the international oil market after sanctions were lifted against the country under an international agreement with major world powers to restrict its nuclear work that took effect in January.

What is the current price of Oil?

Brent crude, the main international benchmark, is trading around $39 a barrel, where as the American benchmark WTI is at around $38 a barrel.

Why has the price of Oil been dropping? Why Now?

This a complicated question, but it boils down to the simple economics of supply and demand.

United States domestic production has nearly doubled over the last several years, pushing out oil imports that need to find another home. Saudi, Nigerian and Algerian oil that once was sold in the United States is suddenly competing for Asian markets, and the producers are forced to drop prices. Canadian and Iraqi oil production and exports are rising year after year. Even the Russians, with all their economic problems, manage to keep pumping.

There are signs, however, that production is falling because of the drop in exploration investments. RBC Capital Markets has calculated projects capable of producing more than a half million barrels a day of oil were cancelled, delayed or shelved by OPEC countries alone last year, and this year promises more of the same.

But the drop in production is not happening fast enough, especially with output from deep waters off the Gulf of Mexico and Canada continuing to build as new projects come online.

On the demand side, the economies of Europe and developing countries are weak and vehicles are becoming more energy-efficient. So demand for fuel is lagging a bit.

Who benefits from the price drops?

The biggest winner of Low Oil prices are Oil Importing countries, as their import bills have reduced significantly.

Who Loses?

For starters, oil-producing countries and states. Venezuela, Nigeria, Ecuador, Brazil and Russia are just a few petrostates that are suffering economic and perhaps even political turbulence.

The impact of Western sanctions caused Iranian production to drop by about one million barrels a day in recent years and blocked Iran from importing the latest Western oil field technology and equipment. With sanctions now being lifted, the Iranian oil industry is expected to open the taps on production soon.

In the United States, there are now virtually no wells that are profitable to drill.

Chevron, Royal Dutch Shell and BP have all announced cuts to their payrolls to save cash, and they are in far better shape than many smaller independent oil and gas producers.

States like Alaska, North Dakota, Texas, Oklahoma and Louisiana are facing economic challenges.

There has also been an uptick in traffic deaths as low gas prices have translated to increased road travel. And many young Saudis have seen cushy jobs vanish.

What are the New challenges for producers ?

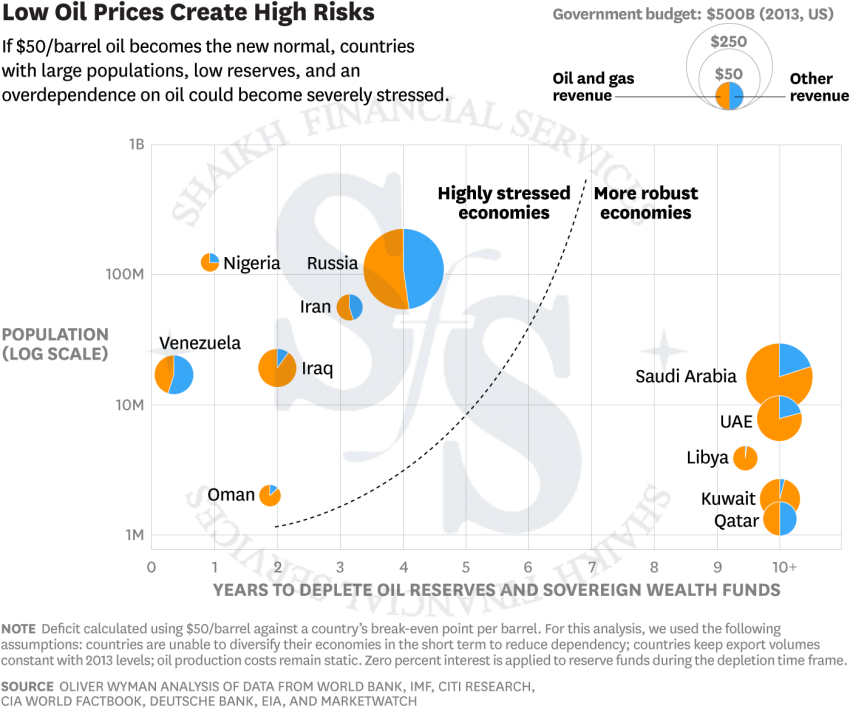

Depending on how nations react, a lower per-barrel oil price could result in a new balance of power in the oil industry. We recently conducted a study to test the impact of sustained $50 oil on oil-producing countries. The results showed that $50 oil puts some producing countries under considerable stress as they grapple with less oil revenue in their national budgets. Venezuela, Nigeria, Iraq, Iran, and Russia could be forced to address substantial budget deficits within the next five years.

Gulf Cooperation Council (GCC) producers such as Saudi Arabia, the United Arab Emirates, Kuwait, and Qatar have amassed considerable wealth during the past decade through cash reserves and sovereign wealth funds. But even these countries could come under stress in the next decade if they continue to follow their status quo.

Depending on how nations react, a lower per-barrel oil price could result in a new balance of power in the oil industry. We recently conducted a study to test the impact of sustained $50 oil on oil-producing countries. The results showed that $50 oil puts some producing countries under considerable stress as they grapple with less oil revenue in their national budgets. Venezuela, Nigeria, Iraq, Iran, and Russia could be forced to address substantial budget deficits within the next five years.

Gulf Cooperation Council (GCC) producers such as Saudi Arabia, the United Arab Emirates, Kuwait, and Qatar have amassed considerable wealth during the past decade through cash reserves and sovereign wealth funds. But even these countries could come under stress in the next Five years if they continue to follow their status quo.

Cheap Oil is crushing which Middle Eastern Countries?

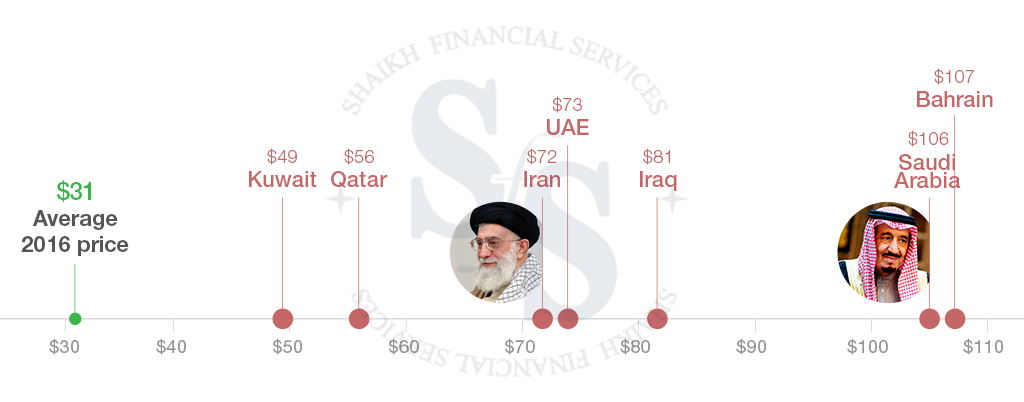

Saudi Arabia, Qatar and Iran rely on oil exports. Oil under $49 a barrel is already below the break-even point for many middle eastern nations’ budgets, which means current prices are really hurting.

The Illustration below shows the Break Even Point for Middle Eastern Countries’ Budget. Source: IMF

What happened to OPEC?

Iran, Venezuela, Ecuador and Algeria have all pressed OPEC, a cartel of oil producers, to cut production to firm up prices. At the same time, Iraq is actually pumping more, and Iran is expected to become a major exporter again.

Major producing countries will meet on April 17 in Qatar, and some analysts think a cut may be possible, especially if oil prices approach $30 a barrel again.

King Salman, who assumed power in Saudi Arabia in January 2015, may find it difficult to persuade other OPEC members to keep steady against the financial strains, even if Iran continues to increase production. The International Monetary Fund estimates that the revenues of Saudi Arabia and its Persian Gulf allies will slip by $300 billion this year.

Is there a Conspiracy to bring the price of Oil down?

There are a number of conspiracy theories floating around. Even some oil executives are quietly noting that the Saudis want to hurt Russia and Iran, and so does the United States — motivation enough for the two oil-producing nations to force down prices. Dropping oil prices in the 1980s did help bring down the Soviet Union, after all.

But there is no evidence to support the conspiracy theories, and Saudi Arabia and the United States rarely coordinate smoothly. And the Obama administration is hardly in a position to coordinate the drilling of hundreds of oil companies seeking profits and answering to their shareholders.

What are the Oil & Gas revenues for some top Oil producing countries?

When are Oil prices likely to recover?

Oil markets have bounced back more than 40 percent since hitting a low of $26.21 a barrel in New York in early February. Moving ahead prices are likely to remain highly volatile, hence creating trading opportunities both on LONG and SHORT Side for smart Technical Analysts.

Research Team,

Shaikh Financial Services