Bitcoin: What’s Next ?

Bitcoin is currently trading at $11,500, below the major resistance of $12,500.

We believe prices are going to reverse from here, without breaking the all-important $12,500 mark.

Price reversal towards at-least $10,000 seems likely. Sustained Break below $9800 has the potential to drag the prices much lower. On the other hand, any sustained move above the $12,500 level will favour the BULLS, otherwise BEARS still hold an edge.

- Published in Commodities

Bitcoin Trade Call Update.

Bitcoin recently made a low of $9200 and is in the recovering mode. Current Prices are hovering around the $11,600 mark. As per our technical analysis, we are considering this price move as a Dead Cat Bounce and we believe downtrend will resume very soon & this time it will even break the $8700 level mark and later we might even see $7000.

Hold your nerves, Add few more SHORT Position on any price strength with Stop-Loss at $14,500, keeping in view the targets of $8700 & $7000.

Best of Luck

Note: This Post is with reference to our earlier post titled Bitcoin -Top In The Making.

- Published in Commodities

Bitcoin: TOP In The Making, Free Exclusive Trade Call

Bitcoin is currently trading just under the $20,000 mark (Current Price $19,400).

Technically this parabolic move is way too stretched & it is more likely that the Top of this move is going to be somewhere in-between 19,500 – 22,500.

We are giving a SHORT SELL Call at the current Price of $19,400 with a Stop-Loss at 22,700.

Our Very Short Term Target is $15,400, then later $12,200 & Finally $8700.

We are of the view that $8700 will be achieved within next few weeks or so.

Keep SHORT Positions till the time this target of $8700 is achieved.

Once price starts to decline adjust your stop-loss according to your risk taking capacity. Generally speaking if and when price comes down to $15,400, move your stop-loss to $ 18,400.

Note : We believe that Big Boys of Wall Street will be in action (by SHORT-SELLING Bitcoin) as Bitcoin Futures Trading Begins at CME.

Best Of Luck.

- Published in Commodities

Protected: PSX Strategy For Investors

- Published in Stocks

Gold Update: Free Trade Call

We gave a Buy call at 1213/Oz few days back. Gold is currently trading at 1283, Close your BUY positions which were initiated on our call and book $70/oz Profit.

Swing Trading Entry:

SHORT SELL Gold at current rate of 1283/82 with a target of 1263. Place Stop-Loss at 1292.

Hope you enjoyed our FREE trading Call.

You are requested to Remember us in your prayers.

Note: To become our client & to get daily trade calls, contact us for details.

Research Team,

Shaikh Financial Services.

- Published in Commodities

PSX UPDATE – PANAMA HUNGAMA

PSX Update: Panama Hungama …!!

It has been announced that Panama Judgement will come out at 2 O Clock (Thursday 20th April 2017).

Kse-100 index just touched 46,048 and is reversing from there. Current Index is at 46,520.

We recommend all of you to cut ALL your SHORT Positions which were initiated at 50,300 on our call. (It’s a Gain of almost 4000 index points).

Technically we believe for the time being index bottom has been placed and index is reversing for potential target of 48,200 and then 49,700.

After closing all Short Positions New Long Positions can be taken in the following stocks.

BUY CALL:

For Technical Trading- TRG, SNGP, FCCL, ASL & EPCL can be bought here with Index Stop Loss of 45,950.

SFS Research,

Shaikh Financial Services

- Published in Stocks

TRUMP to win the US Elections… !!

All polls are predicting that Hillary Clinton has an edge over Trump, We think the opposite.

Historically, the market performance in the three months leading up to a Presidential Election has displayed an uncanny ability to forecast who will win the White House… the incumbent party or the challenger. Since 1928, there have been 22 Presidential Elections.In 14 of them, the S&P 500 climbed during the three months preceding election day. The incumbent President or party won in 12 of those 14 instances. However, in 7 of the 8 elections where the S&P 500 fell over that three month period, the incumbent party lost.

There are only three exceptions to this correlation: 1956, 1968, and 1980. Statistically, the market has an 86.4% success rate in forecasting the election!

The mentioned relationship occurs because the stock market reflects the economic outlook in the weeks leading up to the election. A rising stock market indicates an improving economy, which means rising confidence and increases the chances of the incumbent party’s re-election.

Till Today, the S&P500 has declined nine consecutive trading days, the first time it has done so since 1980. S&P has fallen some 4.5% over the critical three month period, suggests that based on this indicator, Trump has a roughly 86% chance of winning the presidential election. Alternatively, if only looking at the eight distinct cases in which the market declined in the 3 months heading into the election, there was just one occasion in which the pattern did not hold and the incumbent party was booted out on 7 of those occasions, boosting Trump’s implied odds of success even higher, to 87.5%.

TRUMP to win the US Elections !!

Research Team

Shaikh Financial Services.

- Published in Stocks, Uncategorized

Impact of FED’s Interest Rate Decision on Gold Prices.

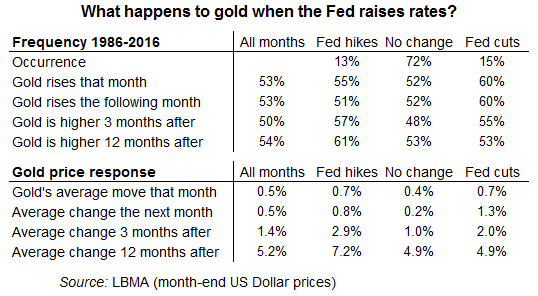

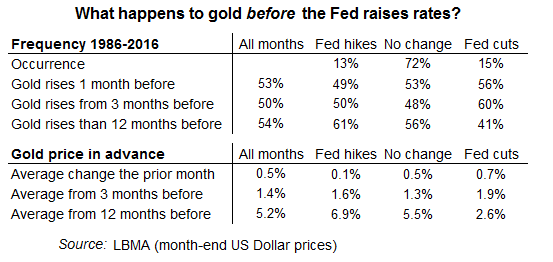

Although theory says that gold price should decline after an interest rate hike and it should increase after an interest rate cut, history shows that this anticipation is often wrong. The Gold market always try to predict the future development, and the interest rate change is often reflected by the prices before the rate change itself is officially announced. If there was a strong trend before the rate change, the trend may get disrupted for some time, although it tends to resume after the dust settles down.

It’s a fact that making money from financial trading means getting ahead of the move, buying before an asset goes up and selling it before it goes down. So if gold should fall when Fed rates go up – like everyone thinks, because it pays no income and so carries an opportunity cost in the form of lost interest on cash – then no one should want to wait. Sell early, provided you’re sure you know which way the Fed will go.

The story is that selling in advance works to depress gold prices before the Fed makes its announcement (just like buying before a rate cut pushes it higher). Brought forward in time, this self-fulfillment cracks open a gap between what intuitions says gold should do when the Fed raises (or cuts) and what actually happens after the fact.

Gold had first failed to reclaim that peak in 2012 when the Fed expanded its quantitative easing bond-buying program to $85 billion per month. Then gold sank in 2013 (as now ex-chairman Ben Bernanke muttered about ‘tapering’ QE) before steadying in 2014 (even as the taper became fact) only to slide again in 2015 (as Janet Yellen muttered time and again that her committee would, like, really really raise rates from zero before the end of last year).

The Fed squeezed its first hike into 2015, but only just! ‘Will they? When?’ finally ended, gold prices have barely looked back, marking 2016 with the strongest half-annual gains since the financial crisis broke in 2008. The Federal Reserve’s first interest-rate hike after 7 years stuck at zero last December finally put gold out of its misery. Marking a new 6-year low, gold prices hit $1046 per ounce straight after the Fed rate rise. A 27% jump came as the Fed failed to follow up with a second rate hike, never mind the two or three needed by September to keep the central bank’s own 2016 forecast on track. This is now the longest “pause” in any modern interest-rate cycle. Even if the Fed does raise at this week’s meeting, it begs the question whether this qualifies as a rate-hiking cycle. The Fed never waited so long as it did in 2009-2015 before making a change to rates. It has never now hemmed and hawed this long before following one rise with another.

Still, gold prices have softened over the summer, easing $50 per ounce from the 2-year Dollar peak of $1375 hit immediately after the UK’s Brexit referendum shock. Desperate as always for a narrative of ‘this plus that equals the other’, financial newswires and traders put gold’s retreat entirely down to Fed chit-chat – because some Fed members have switched to calling for a second rate rise sooner, rather than later, fretting about unintended consequences from today’s near-record low ceiling of 0.50%.

Well, go on then Janet, Stanley, Lael and the rest. Gold dares you.

Research Desk,

Shaikh Financial Services

- Published in Commodities

BREXIT will Happen, Black FRIDAY on the Cards.

BLACK FRIDAY IN THE MAKING:

Since last 4 months i am of the opinion that BREXIT will happen.

Now it’s time to take few entries in the Financial Markets based on our prediction that BREXIT will happen.

GBPUSD: Sterling currently is trading around 1.4950.

Everyone should SHORT-SELL the Hell out of it. Place your Stop-Loss at 1.5300. Target is 1.3450.

Note: If the trade comes out right we will be able to book a profit of 1500 pips within 24-36 hrs, otherwise we will loose 350 pips. The Risk and Reward Ratio is perfect and technically i am confident that our target will be achieved.

——————————————————————————————————————-

GOLD: Gold is currently hovering around 1265/Oz.

We are BUYING gold at current price of 1265, Stop-Loss should be placed at 1240 and Target should be 1345/Oz.

——————————————————————————————————————-

CRUDE OIL: Crude Oil is trading at around 50.30/Brl.

We will not take any Position in CRUDE OIL at the moment, but for your guidance, i would like to comment that Crude will take a hit and will decline on BREXIT.

——————————————————————————————————————-

STOCKS:

Stocks Markets all across the Globe will take a severe beating, specially DOW, FTSE, NIKKEI.

& Yes PSX will also take a hit.

Just to Recall, We had already liquidated All our PSX holdings last week, which were bought at 31,000 index level few months back. We will be coming out with a New PSX Strategy over the weekend.

——————————————————————————————————————-

NOTE: At the moment, We don’t need to take position in everything, we will just take positions in GBPUSD and GOLD.

Once these 2 trades are complete, all of you will be guided via WhatsApp about the next Strategy.

Wishing you all the very best,

Raheel Shaikh.

- Published in Commodities, Stocks