PSX UPDATE – PANAMA HUNGAMA

PSX Update: Panama Hungama …!!

It has been announced that Panama Judgement will come out at 2 O Clock (Thursday 20th April 2017).

Kse-100 index just touched 46,048 and is reversing from there. Current Index is at 46,520.

We recommend all of you to cut ALL your SHORT Positions which were initiated at 50,300 on our call. (It’s a Gain of almost 4000 index points).

Technically we believe for the time being index bottom has been placed and index is reversing for potential target of 48,200 and then 49,700.

After closing all Short Positions New Long Positions can be taken in the following stocks.

BUY CALL:

For Technical Trading- TRG, SNGP, FCCL, ASL & EPCL can be bought here with Index Stop Loss of 45,950.

SFS Research,

Shaikh Financial Services

- Published in Stocks

TRUMP to win the US Elections… !!

All polls are predicting that Hillary Clinton has an edge over Trump, We think the opposite.

Historically, the market performance in the three months leading up to a Presidential Election has displayed an uncanny ability to forecast who will win the White House… the incumbent party or the challenger. Since 1928, there have been 22 Presidential Elections.In 14 of them, the S&P 500 climbed during the three months preceding election day. The incumbent President or party won in 12 of those 14 instances. However, in 7 of the 8 elections where the S&P 500 fell over that three month period, the incumbent party lost.

There are only three exceptions to this correlation: 1956, 1968, and 1980. Statistically, the market has an 86.4% success rate in forecasting the election!

The mentioned relationship occurs because the stock market reflects the economic outlook in the weeks leading up to the election. A rising stock market indicates an improving economy, which means rising confidence and increases the chances of the incumbent party’s re-election.

Till Today, the S&P500 has declined nine consecutive trading days, the first time it has done so since 1980. S&P has fallen some 4.5% over the critical three month period, suggests that based on this indicator, Trump has a roughly 86% chance of winning the presidential election. Alternatively, if only looking at the eight distinct cases in which the market declined in the 3 months heading into the election, there was just one occasion in which the pattern did not hold and the incumbent party was booted out on 7 of those occasions, boosting Trump’s implied odds of success even higher, to 87.5%.

TRUMP to win the US Elections !!

Research Team

Shaikh Financial Services.

- Published in Stocks, Uncategorized

BREXIT will Happen, Black FRIDAY on the Cards.

BLACK FRIDAY IN THE MAKING:

Since last 4 months i am of the opinion that BREXIT will happen.

Now it’s time to take few entries in the Financial Markets based on our prediction that BREXIT will happen.

GBPUSD: Sterling currently is trading around 1.4950.

Everyone should SHORT-SELL the Hell out of it. Place your Stop-Loss at 1.5300. Target is 1.3450.

Note: If the trade comes out right we will be able to book a profit of 1500 pips within 24-36 hrs, otherwise we will loose 350 pips. The Risk and Reward Ratio is perfect and technically i am confident that our target will be achieved.

——————————————————————————————————————-

GOLD: Gold is currently hovering around 1265/Oz.

We are BUYING gold at current price of 1265, Stop-Loss should be placed at 1240 and Target should be 1345/Oz.

——————————————————————————————————————-

CRUDE OIL: Crude Oil is trading at around 50.30/Brl.

We will not take any Position in CRUDE OIL at the moment, but for your guidance, i would like to comment that Crude will take a hit and will decline on BREXIT.

——————————————————————————————————————-

STOCKS:

Stocks Markets all across the Globe will take a severe beating, specially DOW, FTSE, NIKKEI.

& Yes PSX will also take a hit.

Just to Recall, We had already liquidated All our PSX holdings last week, which were bought at 31,000 index level few months back. We will be coming out with a New PSX Strategy over the weekend.

——————————————————————————————————————-

NOTE: At the moment, We don’t need to take position in everything, we will just take positions in GBPUSD and GOLD.

Once these 2 trades are complete, all of you will be guided via WhatsApp about the next Strategy.

Wishing you all the very best,

Raheel Shaikh.

- Published in Commodities, Stocks

Is MSCI EM Status for PAKISTAN Likely ?

MSCI is considering a reclassification of Pakistani Equity market from Frontier to Emerging market status on 14th June 2016.

MSCI – A leading provider of research-based indexes and analytics, announced today that it will release on June 14, 2016, shortly after 11:00 p.m. Central European Summer Time (CEST), the results of the 2016 Annual Market Classification Review. As a reminder, three MSCI Country Indexes are currently included on the review list of the 2016 Annual Market Classification Review: MSCI China A and MSCI Pakistan Indexes for a potential reclassification to Emerging Markets and MSCI Peru Index for a potential reclassification to Frontier Markets.

It is important to note that MSCI is not the only index provider that classifies markets – but is considered the reference benchmark for many markets. MSCI and other index providers base their market classification on a number of quantitative measurable and comparative criteria while aiming to avoid qualitative and/ or subjective criteria.

PAKISTAN: ECONOMY IN FOCUS

Pakistan is a country with a population of 190 million people. Pakistan’s GDP stands at USD 250 Billion (Year 2015). Pakistan’s economy continued to pick up in the Fiscal Year 2015 as economic reform progressed and security improved. Inflation markedly declined, and the current deficit narrowed with favourable prices for oil and other commodities. Despite global headwinds, the outlook is for continued moderate growth as structural and macroeconomic reforms deepens.

| Selected economic indicators (%) – Pakistan | 2015 | 2016 Forecast | 2017 Forecast |

| GDP Growth | 4.2 | 4.5 | 4.8 |

| Inflation | 4.5 | 3.2 | 4.5 |

| Current Account Balance (share of GDP) | -1.0 | -1.0 | -1.2 |

CPEC : THE GAME CHANGER FOR PAKISTAN

China Pakistan economic corridor (CPEC) is a mega project of USD 46+ Billion taking the bilateral relationship between Pakistan and China to new heights. The project is the beginning of a journey of prosperity of Pakistan and China’s Xinjiang. The economic corridor is about 3000 Kilometers long consisting of Highways, Railways and Pipelines that will connect China’s Xinjiang province to the rest of the world through Pakistan’s Gwador port.

The investment on the corridor will transform Pakistan into a regional economic hub. The corridor will be a confidence booster for investors and attract investment not only from China but other parts of the world as well. Other than transportation infrastructure, the economic corridor will provide Pakistan with the telecommunications and energy infrastructure.

MSCI INDICES & PAKISTAN – A QUICK RECAP.

It is important to mention that Between 1994- 2008 Pakistan was part of the MSCI Emerging Markets Index. After the Balance of Payment crisis in 2008, KSE was shut down for 4 months after which the country was kicked out of the Emerging Markets Index. In May 2009 Pakistan was added back in the MSCI Index, but this time it was added in the Frontier Markets Index.

June last year MSCI put Pakistan up for official review regarding inclusion into Emerging Markets. Now as per today’s Press release MSCI will make its decision whether to upgrade or not on 14th of June.

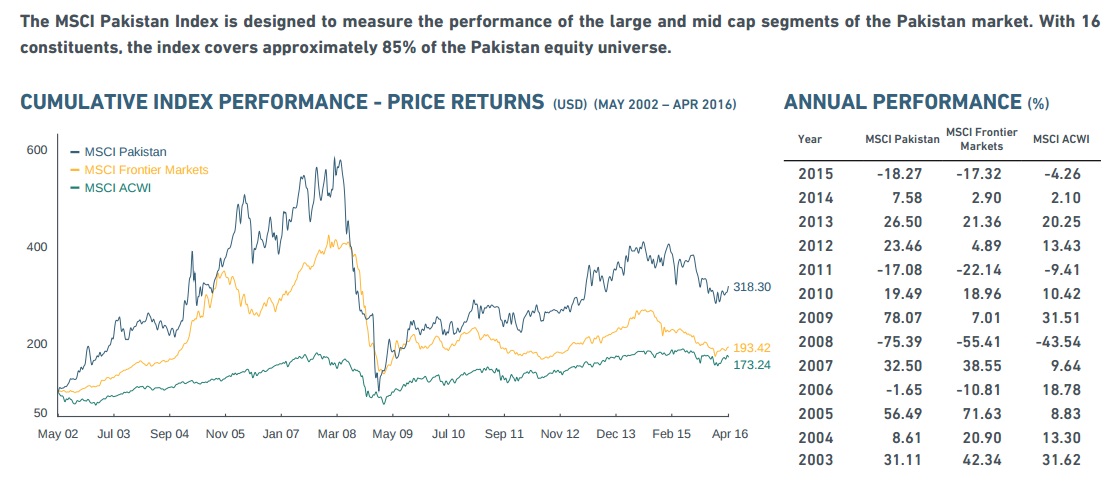

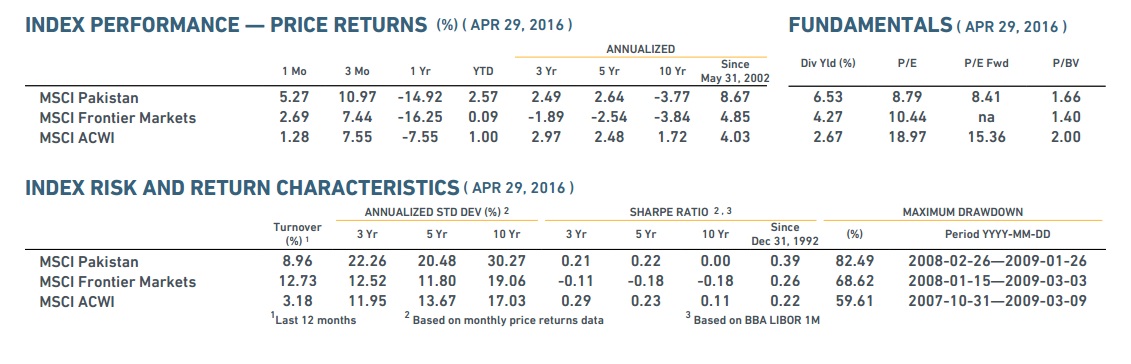

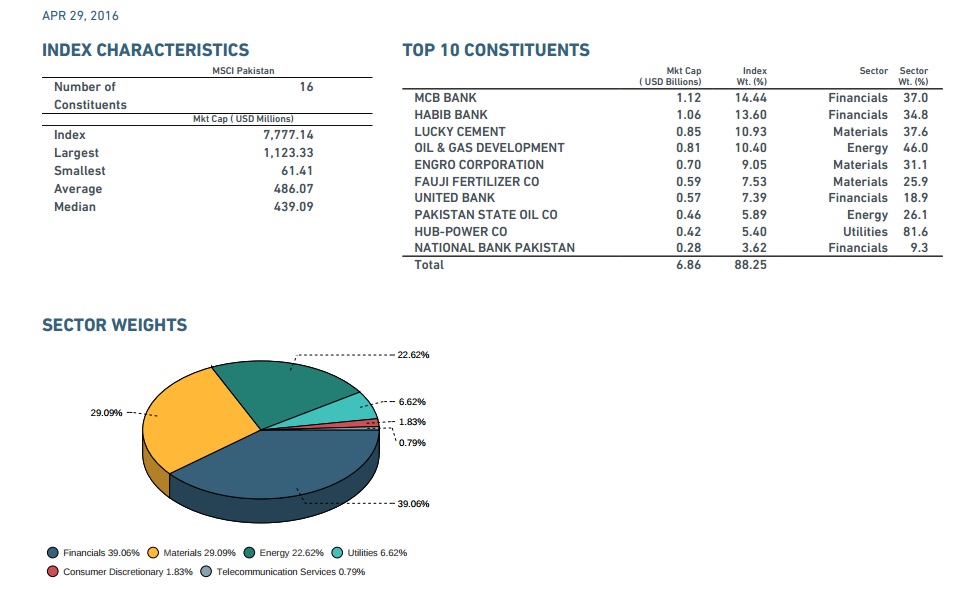

RECAP : THE MSCI PAKISTAN INDEX

INDEX METHODOLOGY:

The index is based on the MSCI Global Investable Indexes (GIMI) Methodology—a comprehensive and consistent approach to index construction that allows for meaningful global views and cross regional comparisons across all market capitalization size, sector and style segments and combinations. This methodology aims to provide exhaustive coverage of the relevant investment opportunity set with a strong emphasis on index liquidity, investability and replicability. The index is reviewed quarterly—in February, May, August and November—with the objective of reflecting change in the underlying equity markets in a timely manner, while limiting undue index turnover. During the May and November semi-annual index reviews, the index is rebalanced and the large and mid capitalization cutoff points are recalculated.

SOME IMPORTANT NUMBERS/STATS:

WHAT TO LOOK FOR IF PAKISTAN ENTERS MSCI EMERGING MARKETS INDEX ?

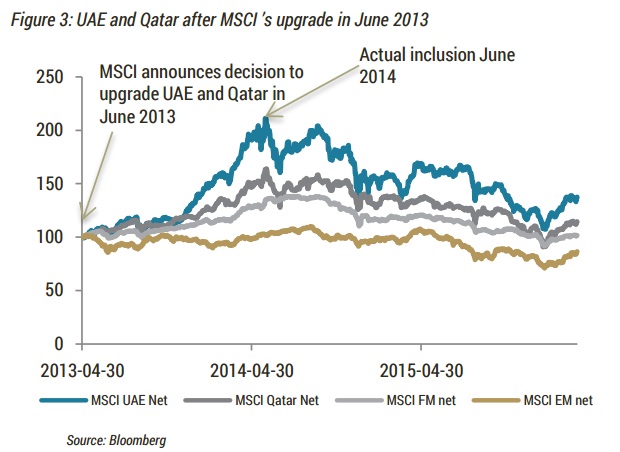

If the decision is positive Emerging Markets funds with 40-50 times the capital of Frontier funds will be forced to have a look at Pakistan. In our view this is an opportunity with a risk-reward skewed heavily towards the positive side.

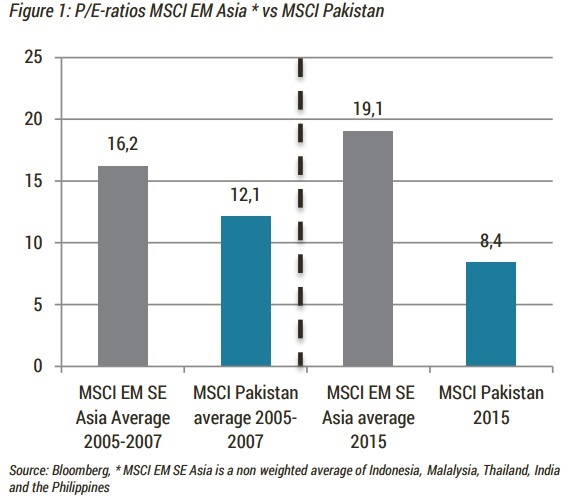

PSX currently trades at 9.0x earnings, companies have grown faster than their regional peers in USD over the last ten years. Should Pakistan enter MSCI Emerging Markets it does so at more than 40% P/E-discounts to its Asian EM peers. We don’t believe this is sustainable, hence calls for a re-rating of the valuations.

OUR STANCE:

We are of the view that it is likely that Pakistan will be given a Green Signal for entering MSCI Emerging Markets on 14th June 2016.

We caution against the notion that reclassification is a panacea for market ills or under-performance. Typically, reclassification (both upgrades and downgrades) have followed or been accompanied by economic and financial policy reforms, including improvements in market infrastructure. It is these more fundamental and structural reforms that attract and retain international investors and boost the confidence of domestic investors.

Re-classifications are best viewed as signaling a confirmation of policy reforms and changes in market conditions. Hence an identification problem may arise whereby improved market conditions are attributed to market reclassification decisions, whereas they are due to policy actions and reforms which lead to a reclassification. Similarly, we note that reclassification may have perverse effects if there is an ‘overshooting‘ effect whereby speculation leads to higher prices in advance of a reclassification, over and above what would be justified by market/ economic fundamentals. Prices then adjust on the actual reclassification event.

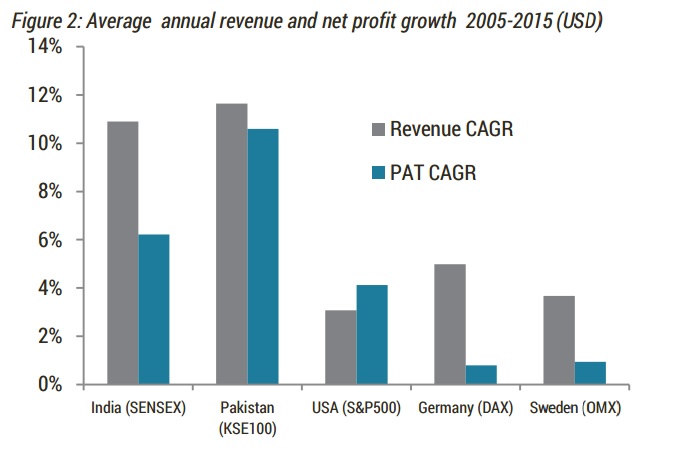

As highlighted in the article Average Annual Revenue and Net Profit Growth of companies listed in Pakistan have been phenomenal between Year 2005 – 2015. Moving forward with CPEC in place, Pakistan’s inclusion in MSCI Emerging Markets Index will be beneficial for both Local as well as Global Investors.

Research Team,

Shaikh Financial Services.

- Published in Stocks

FED Leaves Benchmark INTEREST RATES Unchanged.

As expected the Federal Reserve held the Fed Funds rate target unchanged at 0.25-0.5%. The vote was 9-1, with Kansas City Fed boss Esther George again dissenting from the hawkish side.

As for hints about June, the policy statement takes note of continuing strengthening in labor markets, but also of a moderation in household spending and inflation continuing to run below target.

SUMMARY:

No surprises from the Fed.

Global conditions upgrade.

Domestic growth downgrade.

Data Dependence persists.

No balance of risk assessment.

FOMC Details (27-04-2014) :

The FOMC delivered a statement largely as expected. It upgraded its assessment of the global economy by dropping the reference to risks. It downgraded its assessment of the domestic economy by acknowledging that growth has slowed.

Otherwise is general economic assessment remains little changed. The labor market continues to improve, though growth in household spending has slowed. Housing is stronger though fixed business investment and net exports have been soft (though not as soft as it looked before today’s advance reading of March merchandise trade balance that showed a sharp improvement that spurred some to revise up their forecasts for Q1 GDP due out tomorrow).

The Fed’s forward guidance has not changed. It is looking through the economic soft patch and expects the growth to strengthen. The Fed recognized that inflation is still below target, but as transitory factors subside, it expects to reach 2% in the medium term. The statement left no doubt that the central bank remains data dependent.

There was a little hint about its intentions for June, which follows logically from being data dependent. KC Fed President George repeated her March dissent favoring an immediate hike. The market is not buying it, however. The Fed funds futures continues to price in a small (~20%) chance of a June hike. The markets have whipsawed in response to the statement which helps no surprises.

In addition to not being convinced about the recovery of the domestic economy, many are concerned that global considerations may deter the Fed from hiking in June. The UK referendum takes place a week later. Spain has a do-over election after the vote last December failed to produce a government. European tensions with Greece are on the rise. MSCI Emerging Market equity index has rallied more than 25% since January. Oil is up 70% from its lows. Neither move looks likely to be repeated over the next couple of months.

The Fed’s decision to stand pat here in April, when there was no press conference scheduled, is unlikely to play a significant role in the decisions of other central banks, including the Bank of Japan tomorrow. We earlier argued that the FOMC statement was unlikely to add substantially to investors and policymakers information set. This seems to be very much the case.

Research Team,

Shaikh Financial Services

- Published in Stocks

Center for International Development at Harvard University predicts 5% Economic Growth in Pakistan for next 10 years.

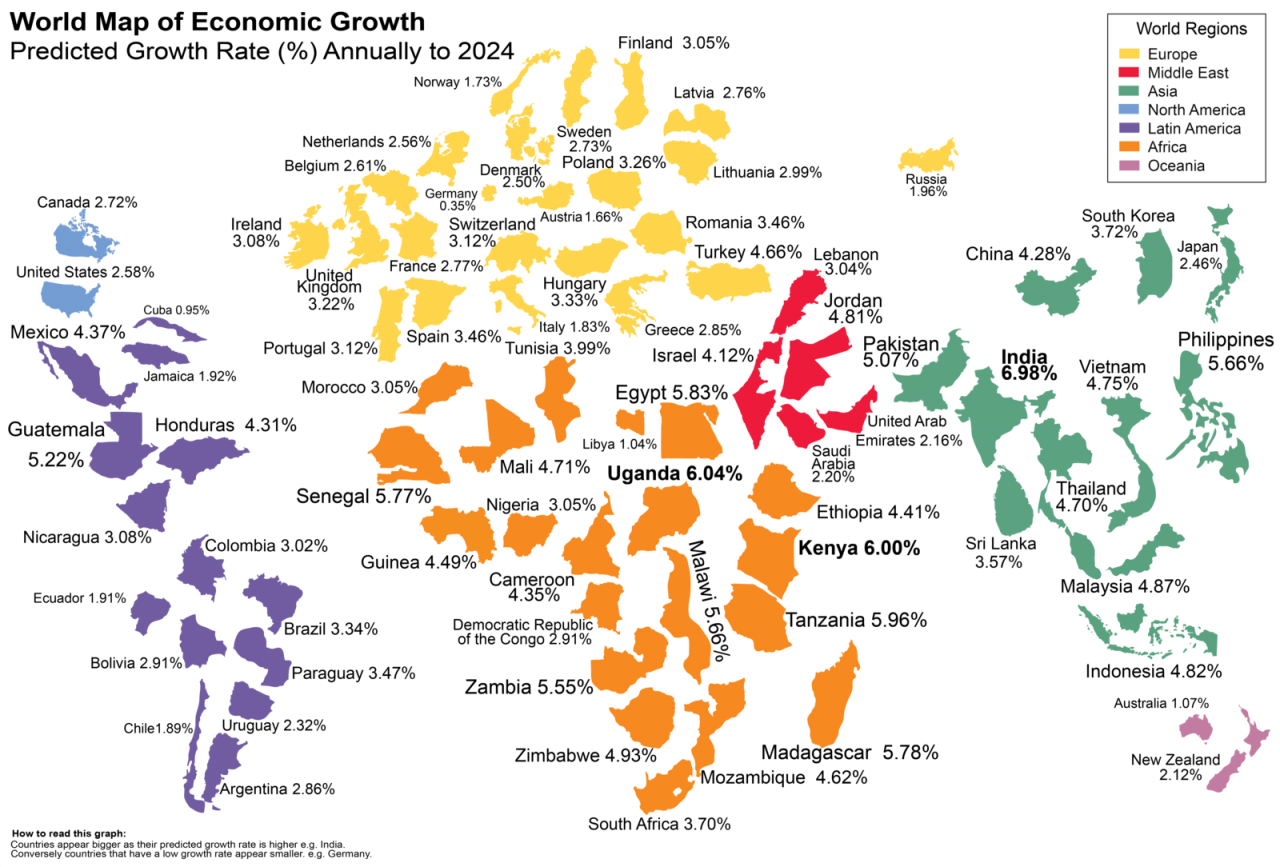

Pakistan’s predicted annual growth rate for the next 10 years is 5.07%.

Experts have predicted that India may be the fastest growing global economy in the next decade. The Center for International Development at Harvard University (CID) is using a newly updated measure of economic complexity to forecast an annual growth rate of 6.98% for India over the next decade. The CID believes that the countries with the greatest potential for growth are located mainly in South Asia and East Africa.

We created the following scaled map to show the forecasted growth rates. The countries are scaled according to their predicted growth rate. Thus, India appears larger than the United States with a predicted growth rate of only 2.58%.

As can be seen from the map, India appears larger on the map than its neighbor China to the north. The CID believes that India will have the highest growth rate because of gains in productive capabilities. These gains have allowed the country to diversify exports into more complex products such as pharmaceuticals, vehicles and electronics. Historically, gains in economic complexity have resulted in higher incomes.

There are a number of countries in East Africa that are projected to grow at least 5.5% annually. Five countries in the region appear on the top ten of the CID list including Uganda, Tanzania, Kenya, Malawi and Madagascar. In addition, there are countries in both the Middle East and South America that appear poised to take off. Jordan and Israel have projected annual growth rates in excess of 4%. Guatemala has a projected growth rate of 5.22%, while Honduras and Mexico are both over 4%.

At the same time, economic growth is anticipated to slow in advanced economies. The U.S. is anticipated to only grow 2.58%. The U.K. is forecasted at a slightly higher 3.22%. Germany, one of the leading economies in Europe, is forecasted with an annual growth rate of only 0.35%. The CID also notes that economies based on commodity output face slower growth rates as commodity prices continue to remain under pressure.

The CID uses economic complexity as their indicator for economic growth after a decade of research. This research has found countries that diversify their production knowledge beyond what is expected see faster income growth. This is a much more accurate indicator of future growth as compared with the popular World Economic Forum Global Competitiveness Index. For example, the CID says that Greece has been an outlier for having a higher income level than would be expected for its level of economic complexity. The country has struggled with average negative annual growth over the past decade.

The CID says that looking at economic complexity may help policymakers. By finding ways to bring new production and product capability into a country, it could help to strengthen growth in the future. The key is getting the new knowledge to come into the area which depends in part on immigration policy, as well as education policy.

About the Center for International Development

The Center for International Development (CID) at Harvard University is a university-wide center that works to advance the understanding of development challenges and offer viable solutions to problems of global poverty. CID is Harvard’s leading research hub focusing on resolving the dilemmas of public policy associated with generating stable, shared, and sustainable prosperity in developing countries. Our ongoing mission is to apply knowledge to and revolutionize the world of development practice.

Research Team,

Shaikh Financial Services

- Published in Stocks

A Dutch dairy cooperative (Friesland Campina International) interested in buying 51% shares of EFOODS from ENGRO Corp.

Engro Corp (ENGRO) has received a public announcement of intention to acquire up to 51% of ENGRO’s shareholding in Engro Foods Limited (EFOODS), amounting to ~340mn shares, by FrieslandCampina International Holding BV, a Dutch dairy cooperative.

ENGRO currently has a 667mn shares stake in EFOODS. Due diligence with regards to the share purchase is expected to commence shortly. The impact of the transaction will be material on ENGRO, resulting in a cash inflow of approx PKR57bn (at an assumed strike price of PKR154/sh) coupled with a gain of approx PKR93/sh.

We believe the gain will be recognized in the consolidated books given loss of ENGRO’s control over EFOODS post execution of the transaction. Post sell-off, the effective shareholding of ENGRO will reduce to 327mn shares (43% of the total shares).

Proceeds generated through selling may potentially be deployed in expansion of Sindh Engro Coal Mining Company (SECMC) and Engro Powergen Thar.

If this deal is materialized, it will be the largest ever deal in the private sector history of Pakistan.

Pakistan is already in the radar range of the world corporate sector and this deal will further lift its image.

Note: FrieslandCampina is the world’s largest dairy cooperative and one of the top 5 dairy companies in the world.

SFS Research

- Published in Stocks

KSE-100 : Market View

Today, KSE-100 Index is trading around the 31,000 level mark.

We are Extremely BULLISH on the index, hence we are giving a STRONG BUY call.

We believe before june 2016, we will see a new ALL time High.

NOTE: HOLD your nerves, Don’t panic, Inshallah we will see a New All time high very soon.

HOLD ALL YOUR STOCKS which we have bought/accumulated in last 3 days.

BEST OF LUCK.

Research Team,

Shaikh Financial Services.

- Published in Stocks

Is Iranian Cement threat to Pakistani Cement Industry ?

After the world economic powers lifted its sanctions on Iran, It has rejoined the world economy once again which has brought a fear of possible penetration of Iranian cement in Pakistan’s local market.

As per our sources from cement industry, local cement manufacturers do not see any major threat from low-quality Iranian cement.

Presently, around 1200k tons per annum of smuggled Iranian cement are being dumped in Pakistan through Taftaan border, Baluchistan. This is a mere 5% of Pakistan’s local cement demand based on FY15 figures.

POSSIBLE CHANNELS THROUGH WHICH IRANIAN CEMENT CAN PENETRATE THE LOCAL MARKET:

1) The first channel is through Baluchistan. We highlight here that there is no proper transportation route to move large quantity of cement from Baluchistan to other areas of Pakistan. Moreover, some areas are seen as a no-go due to presence of militants, which further weakens the possibility of channeling cement through Baluchistan.

2) The second channel is through sea-route which will cost an additional ~US$12/ton shipment charges. This will be in addition to a 20% customs duty imposed by the Govt. in Budget FY16 on imported cement.

SOME FACTS & SCENARIO:

As per our calculations, low-quality Iranian cement will be around Rs50/bag cheaper than the existing local cement of ~Rs500/bag, available in the Southern market. Moreover, to sell cement in the North region, there are additional transportation charges of Rs80-100/bag.

In the worst case scenario, local cement manufacturers will have to reduce their prices by Rs25-30/bag, we believe. In case local players slash their prices by Rs30/bag to compete with the low-quality Iranian cement, we expect gross margins of local cement manufacturers to remain at levels seen in FY15. This will be due to significant decline in power and energy costs (coal down 23% YoY, power tariff down ~20% YoY) which constitute around 60% of the total cement production cost.

This is a Re-Post of our Facebook Page Post.

SFS Research

- Published in Stocks

- 1

- 2